By: DailyForex.com

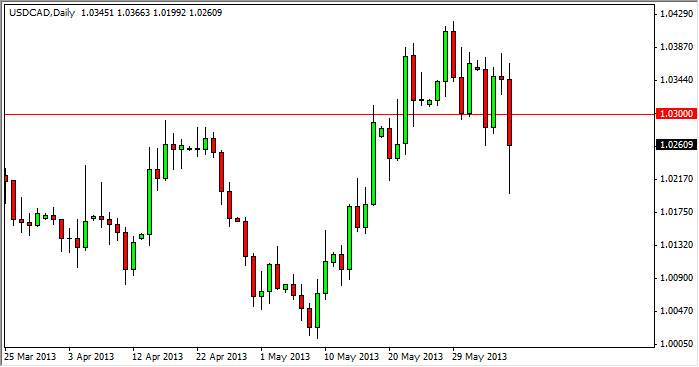

The USD/CAD pair had a very wild ride during the Thursday session, collapsing at one point and shooting straight through the 1.03 level like it didn't even exist. Oddly enough, this was probably predicated upon what was going on in the USD/JPY pair, as it broke down significantly. However, by the end of the session we managed to bounce back above the 1.02 handle, the area that I have been saying needs to be broken on a daily close in order to start shorting this market. In other words, there is no trading even though we have a very wild looking candle.

A lot of people will pay attention to currencies like the Japanese yen and the Euro during nonfarm payroll announcement. For me, this is one of the most interesting markets as the two economies are so interconnected that this pair tends to be very strong in his movements after the announcement.

Canada needs America

Canada send 85% of its exports into the United States. Because of this, the employment situation in America is vital for the Canadian economy. This situation sense of an important correlation between the values of the Canadian dollar in the nonfarm payroll report, as demand for Canadian goods will be directly correlated to whether or not the Americans are working. If you don't have a job, you don't have much interest in buying that Canadian product. The housing market is the other thing that can drive the Canadian dollar from the United States, as so much of the lumber is imported from Canada as well. That being the case, you have to have a job to buy house, and therefore you need to have a job to buy Canadian lumber.

If we manage to close below the 1.02 level, I am still willing to sell this market. However, if we get a fairly strong jobs number there is the possibility that the market assumes that the Federal Reserve will taper off of its quantitative easing sooner, and this of course should drive the value of the dollar higher. If that's the case, a break above the 1.04 level would signal that we should go higher, perhaps as high as 1.10 by the time the entire move is over with.