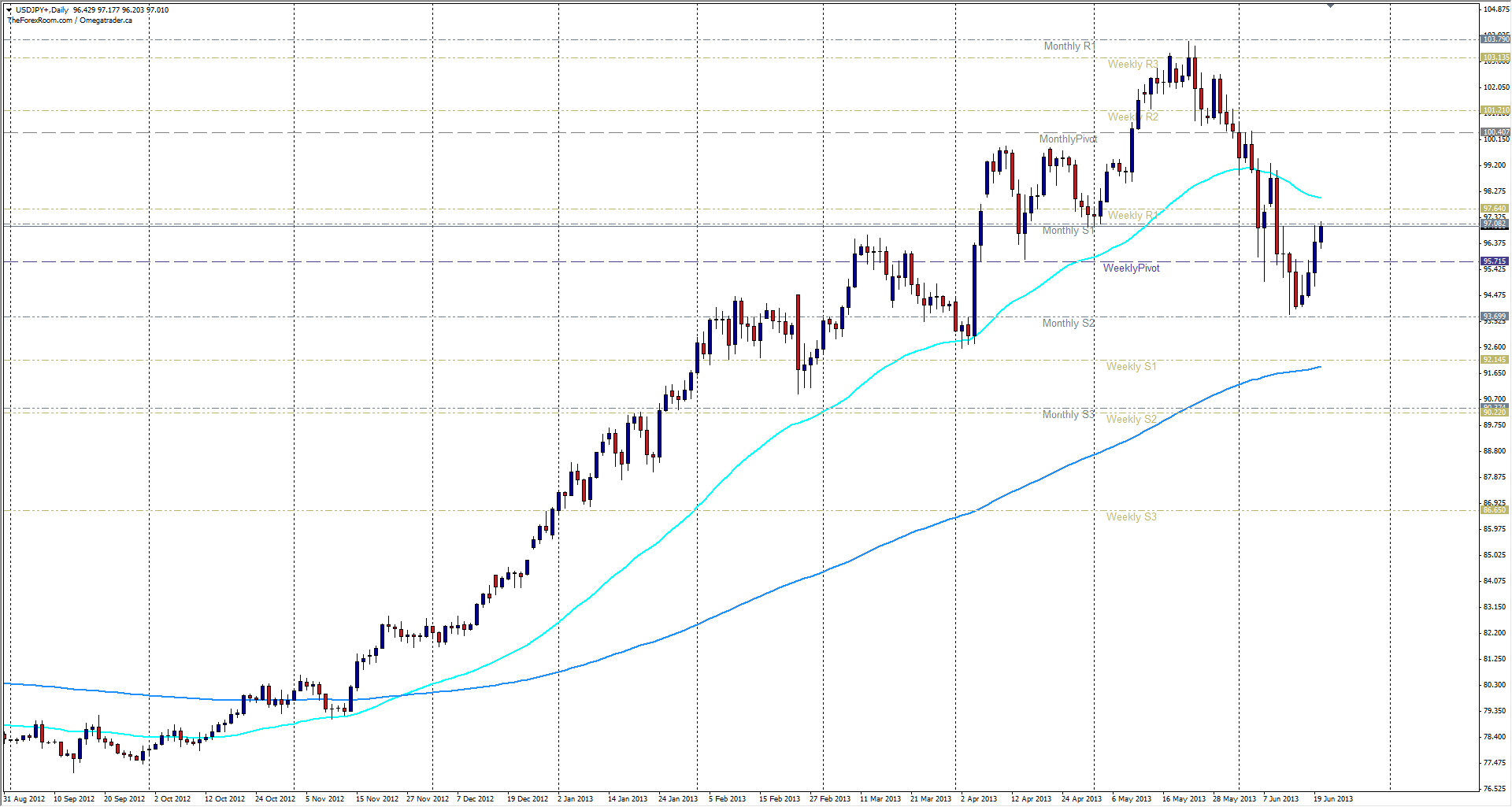

Shinzō Abe must be smiling today. The FOMC announcement yesterday was just what the Yen needed to kick start another bull run. As a result, the Yen has cleared 97.00 in the last 2 hours of the Asian session and is currently trading at 97.048 +/-. The pair is looking bullish on all time frames and after a possible short term pullback that may occur during what traders call The Frankfurt Fake out (the hour before London markets open), there is a strong possibility that we might even hit 98.00 again before the closing bell in New York. Stochastic indicators placed on the daily chart are smashed, indicating that bears continue to be exhausted and bulls are taking control, but there is a resistance level at 97.10 as evidenced by the Monthly S1, Weekly R1 and Daily R1 all converging at the zone established most recently at the end of April. We also have the Daily 50EMA acting as resistance at 98.08 and highs from April in the 99.50 zone. If the bulls do take a break, look for support at 96.10 where March trading peaked and 94.50 where February found its highs.

USD/JPY Clears 97 Again- June 20, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- USD/JPY