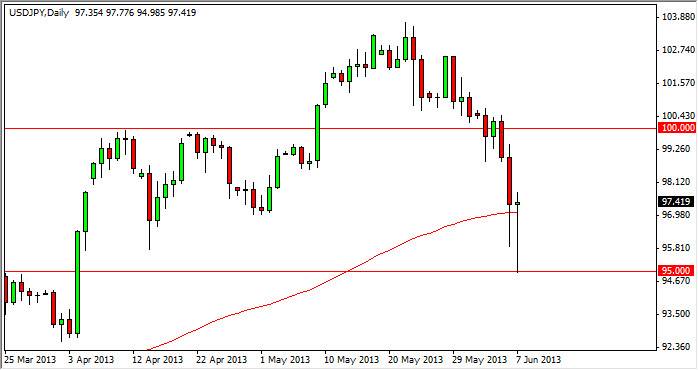

The USD/JPY pair fell during the session on Friday, smashing into the 95 level which of course is a major psychological barrier. The fact that we found so hard and regained 2 1/2 handles suggests to me that there is a ton of support below. I also feel that the fact that we are closing just above the 100 day exponential moving average is something that should not be overlooked as well.

As you know by now, the Bank of Japan is certainly working against the value of the Yen, and the fact that the market bounced so hard at the 95 level speaks volumes to me. I know that recently the Bank of Japan members had suggested that it's comfortable with the range of 95 – 100. That being the case, I get this feeling that a lot of people around the Forex markets were simply waiting for the 95 level in order to start buying again.

I do not however think that the Bank of Japan intervened. There have been a few rumors here and there about that, and truthfully I think that's ridiculous. The last time that they will intervene in the Forex markets would be during a nonfarm payroll announcement. The markets are chaotic enough as it is, and quite frankly they don't care if the pair spends a few hours underneath that level, or above it. In the end, it makes no difference.

We may now have a floor

It appears to me that the 95 level could very well be the floor in this market going forward, and quite frankly I have to admit that I once believe that the 100 level was going to be that's lower. However, as we pull back and show support like this, I cannot help but think it's time to start buying again. The longer-term trend is deftly to the upside in this pair, and I quite frankly think that every time it pullback drastically like this, it will flush out the so-called "weak hands", and let those who have a bit more fortitude enter the market again at a cheaper price. This is exactly what I plan on doing.