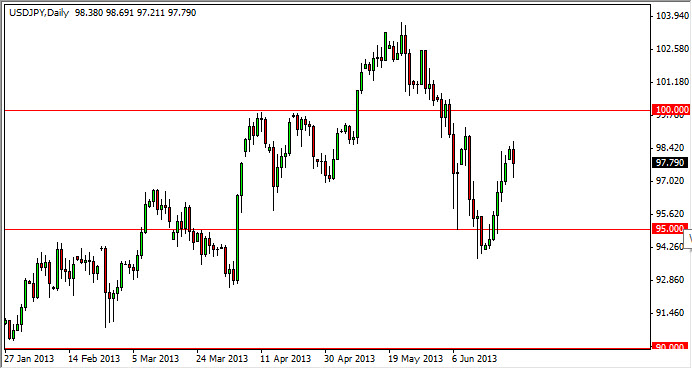

The USD/JPY pair fell during the session on Monday, retracing some of the strength that it had shown recently. Although this market has been falling for the last couple of weeks, I am still fairly bullish of it because I look at the longer-term picture. I have talked to several people recently that have become concerned about this pair, but quite frankly when you look at the longer-term charts, this significant pullback doesn't look so significant anymore.

This is mainly because of the Bank of Japan, and the Federal Reserve. As you all know by now, the Federal Reserve has stated that is looking to get out of the quantitative easing game. As markets try to get ahead of what happens from central banks, we have seen the pair shoot straight up since then. Because of this, a little bit of a pullback has to be expected. After all, markets don't go in one direction forever.

Watch the Bank of Japan

I fully expect to see plenty of jawboning from the Bank of Japan over the next couple of weeks. Also, it's worth noting that some of the Federal Reserve members have done a bit of backpedaling in the press over the last couple of sessions, simply because the market may have reacted a bit stronger to the possibility of higher interest rates and the Federal Reserve had anticipated. Because of this, the one thing you can count on in this pair going forward is volatility.

That being the case, I think that ultimately this is still a nice long-term trade waiting happen. I am buying on dips, and see the 95 handle as a major support area below. A break above the highs from the Monday session, I think we will try to breakout and above the 100 handle. Whether or not we can do that on the first attempt might be a completely different question, but at this point in time I only trade this particular pair in one direction: up.