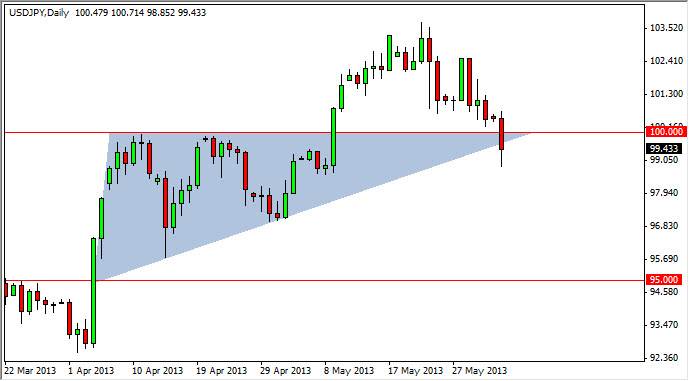

The USD/JPY pair fell rather significantly during the session on Monday, cracking below the 100 handle for the first time in over a month. The 100 handle had significant meaning as it was the top of the ascending triangle that had a breakout in the first place. The real question is this point time is whether or not the markets can get back over that level. Granted, no one expects the market to hold to the exact pip, but the breakdown reached as low as the 99 handle at one point during the session. This of course would have scared quite a few of the bulls out there, and now we will have to see whether or not there is significant momentum to the downside.

The Bank of Japan is still working against the value of the Yen, and as a result I think that eventually we will get that bounce, or the bullishness returning to the market. I should also mention the fact that we are essentially flirting with the uptrend line of the ascending triangle, so there's always that possibility as well, and that we hold based upon that. However, I am not overly optimistic about that particular site of support.

PMI numbers disappoint

With the economic numbers disappointing so much during the Monday session, the currency markets sold off the US dollar because of fears that the Federal Reserve will continue with liquidity measures, and therefore continue to weaken the value of the Dollar over time. This of course works against the favor of this pair, as on the opposite side of the Pacific you have a Japanese central bank that is more than willing to blow up the value of its own currency. In a way, this was the closest thing to a "no-brainer" trade you could've found in the Forex markets.

The real question now is whether or not it was just the "weak hands" they got shaken out of this pair, or something is fundamentally change. At this point time, I believe the former of the two is probably correct. However, I need to see a daily close above 100 in order to start buying. As far as selling is concerned, I would be very hesitant to do so at this point.