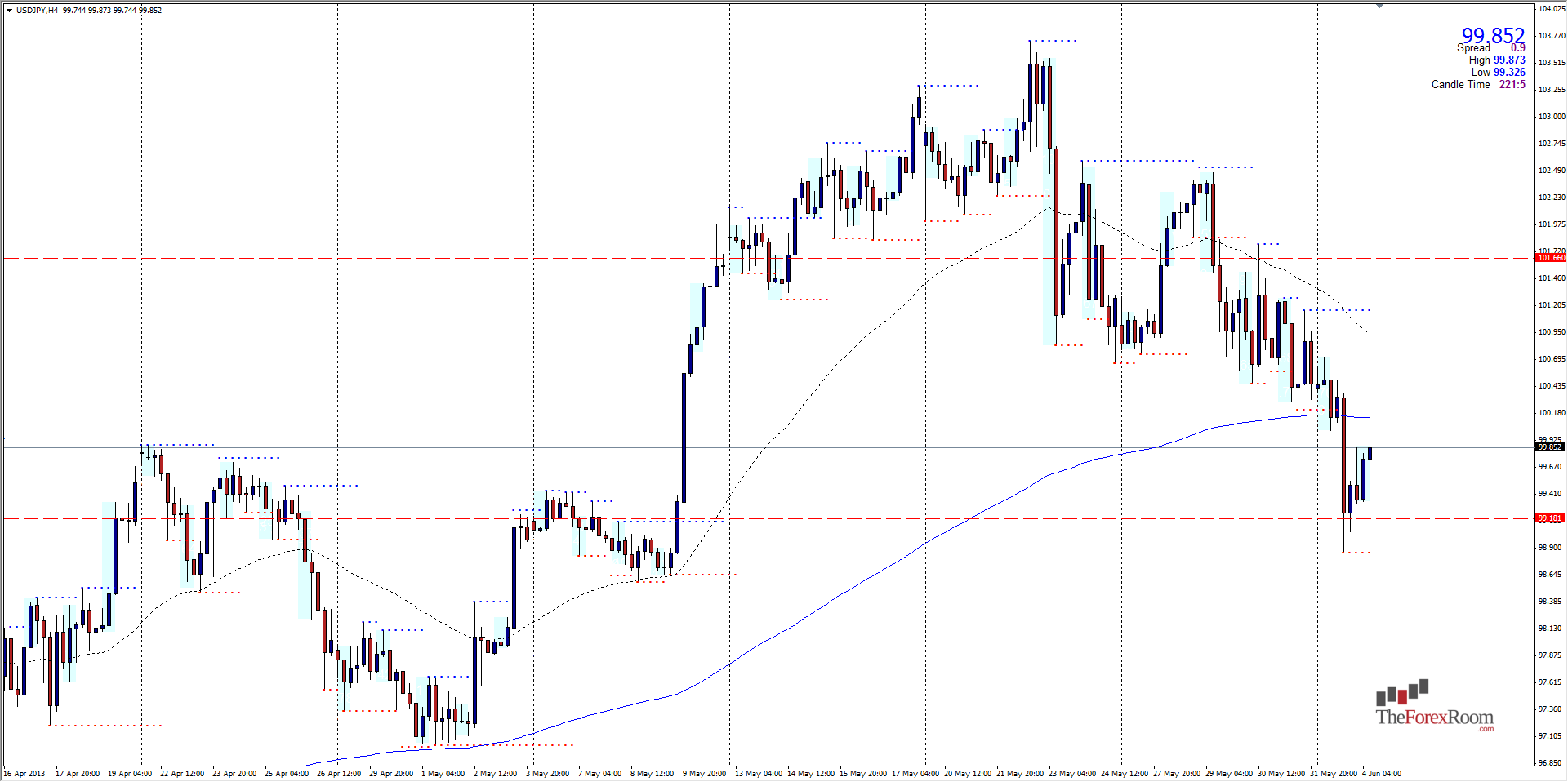

The Japanese Yen strengthened against the US Greenback yesterday and fell to a 3 week low at 98.85. The pair appears to have found support at this level however, with highs from both April and early May at these levels. The pair turned bullish again towards the end of the New York trading day after falling for 3 hours straight after worse than expected manufacturing PMI numbers were released and has since remained slightly bullish throughout most of the Asian session. However, the pair has also closed below the 4 hour 200 moving average and reached the daily 50 moving average at yesterday's lows, so it can go almost anywhere from this point. Tuesdays have been given the name 'Turnaround Tuesday' by traders around the world and today may bring a weaker yen yet again if the idiom holds trun. Immediate resistance will be near Friday's lows at 100.21 and 100.75 with 101.80 also being an important level. 99.20, 98.20 and May's highs of 96.75 will play key support roles in the days ahead.

USD/JPY Tests (& Rejects?) 99.00

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Read more articles by Colin Jessup- Labels

- USD/JPY