EUR/USD

I believe that the EUR/USD pair has hit a significant crossroads. After all, the Federal Reserve now has openly stated that they are looking to pull out of the quantitative easing game, and the European Central Bank looks like it may need to loosen monetary policy even further. Look at the chart, you can see that the weekly trend line to the downside was hit over the past five sessions, and we simply fell from that level. I expect a lot of choppiness below, but rallies should be sold in my opinion.

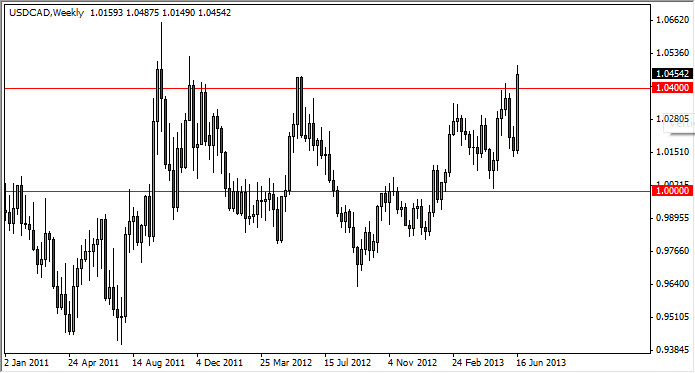

USD/CAD

The USD/CAD pair had a positive week, skyrocketing from Wednesday on. We managed to get above the 1.04 level, an area that I suggested previously was needed to be broken in order to get the next leg higher going. However, there is a possibility of a pullback as the last three sessions have been so parabolic, but those should simply be opportunities to buy this pair. Alternately, I expect see 1.08 hit, as well as 1.10 before the move is all said and done. I could be wrong, and I know that this is a fairly big call, but this pair does tend to move quite rapidly once it makes up its mind.

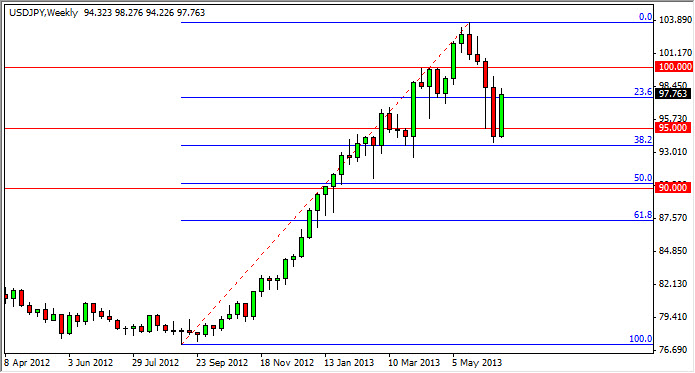

USD/JPY

The USD/JPY pair had a strong showing over the past week, bouncing off of the 38.2 Fibonacci retracement level. This wind up with the 94 handle, which of course has been support in the past, and as a result I think that this market will continue higher. After all, the interest rates in the United States are rising on the 10 year note, while they are falling in Japan overall. This pair is highly sensitive to the 10 year note differential between the two countries, so wherever rates are rising, money flows do. Right now that has this pair going higher.

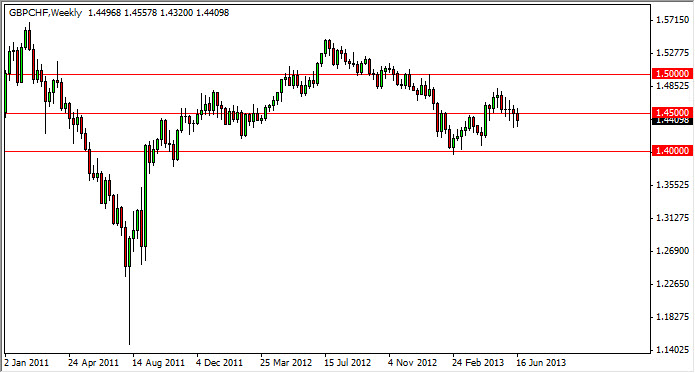

GBP/CHF

The GBP/CHF pair had a negative week overall, but as you can see we have had several neutral looking candles in a row right around the 1.45 handle. On the chart, I have zoomed out quite a bit that you can see that I have the 1.40, the 1.45, and the 1.50 levels drawn on the chart. We have been consolidating between 1.40 and 1.50 over the last two years or so, and as a result I find this to be very reliable and important. Looking at the fact that the last two weeks of been hammer like candle's, I believe a break of the range for this past week will have this market looking for 1.50, but it will be a bit choppy. I other hand, if we don't get that move I would be more than willing to buy supportive candles down at the 1.40 handle.