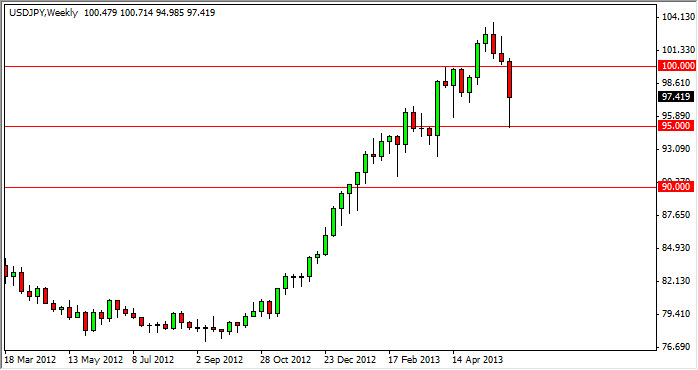

EUR/USD

The EUR/USD pair had a positive week over the last five sessions, and even managed to break above the 1.32 level. However, you can see that we pulled back quite a bit on Friday, which of course gives me a bit of pause. We need to break above the highs from the week in order to continue higher, and if we do I would not be hesitant to go long of this market. On the other hand, we could see the market did back below the 1.32 handle, which to me signifies that we would begin that whole consolidation area that we've been stuck in yet again.

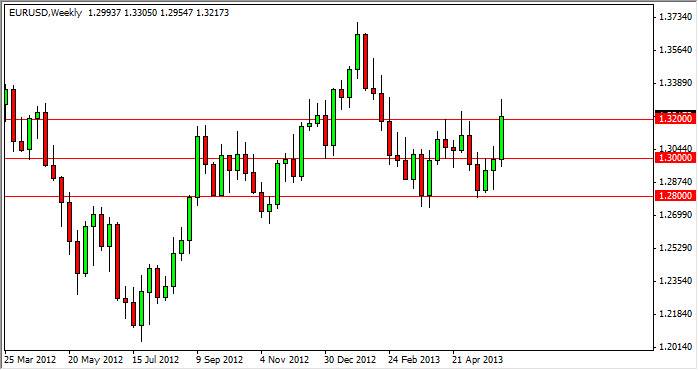

EUR/JPY

The EUR/JPY pair fell rather significantly during the course of the week as all yen related pairs then, but at the end of the day we saw a significant bounce on Friday that formed a nice looking hammer. This hammer is centered on the 130 handle, and as a result I believe that this market is showing us that wants to go higher. That being the case, I am more than willing to start going long now, but I do recognize the fact that above the 130 handle is a significant amount of noise. That noise typically will cause a lot of choppiness in the marketplace, so a trade going long in this pair will have to be accompanied with a significant amount of patience.

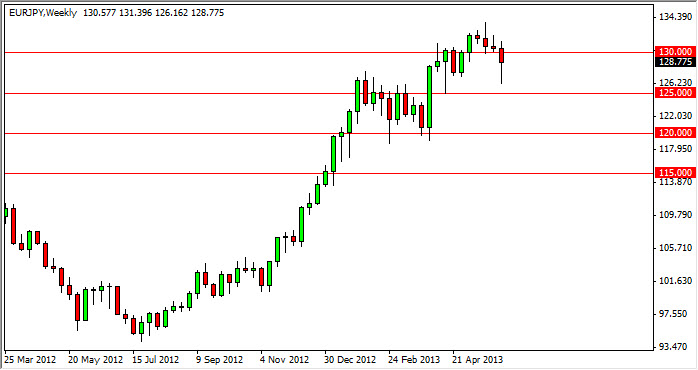

AUD/USD

The AUD/USD pair initially tried to rally during the week, but as you can see a gap stopped at the 0.98 handle. That being the case, we fell drastically from their and closed at the 0.95 handle, but not before testing the 0.94 handle. That being the case, we ended up forming a bearish candle that engulfed the entire range of the previous week, and in the shape of the shooting star. On a break of the bottom that shooting star, I believe that this market goes down to the 0.90 handle relatively quick.

With the commodity market selling off the way they have, and concerns about Chinese slowing, it makes sense that the Australian dollar continues to weaken. In fact, not only does the Aussie look weak, so does the Kiwi and they typically will move in tandem. Because of this, I do believe that we are seeing lower prices soon.

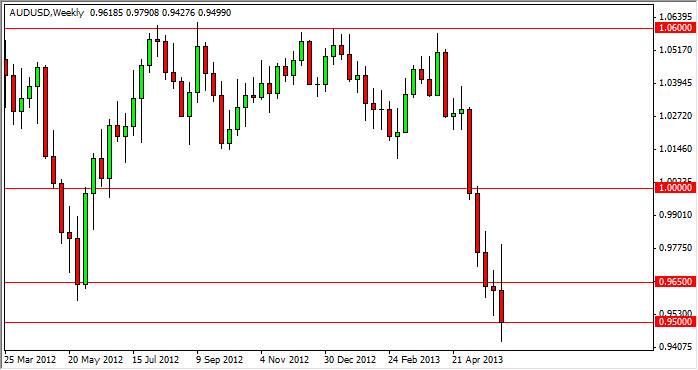

USD/JPY

The USD/JPY pair of course has been the focal point of most Forex traders for some time now. Friday was a very interesting session, as we screened down towards the 95 handle, but found enough support to bounce 241 pips by the end of the day. That being the case, we formed a beautiful looking hammer on Friday, and although the weekly chart doesn't look is as supportive, I am focusing on that Friday hammer as it is also centered on the 100 day EMA. Because of this, I am very bullish of this pair yet again, and believe that we are going much higher.