EUR/USD

The EUR/USD pair rose during the past week, as you can see it clearly broke above the 1.33 handle. However, on this chart I have a downtrend line that shows resistance towards the end of the week. On the daily chart, there are several hammers in a row been form, so I have the sneaking suspicion that this next week is going to be very huge for the Euro in general. I would suspect that the market is waiting on the FMOC meeting later this week, and as a result the fate of the US dollar will be determined whether or not the Federal Reserve Chairman speaks about quantitative easing or not. That being the case, I think that traders will be best served waiting until the end of this next candle before making a decision. However, it is obviously buy the Euro above the trend line, and sell it below.

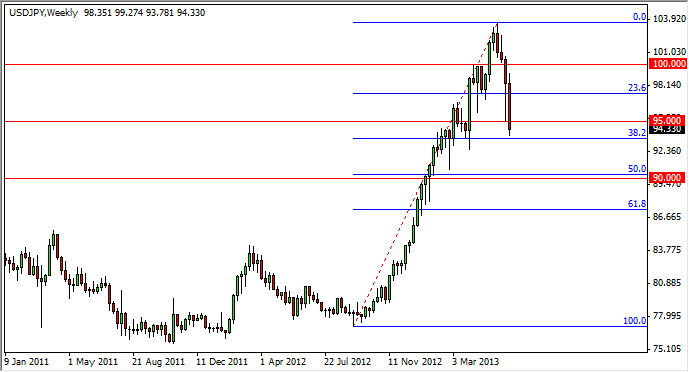

USD/JPY

This pair has given a lot of people headaches over the last couple of weeks. However, when you look at the overall move, even this brutal selloff has only produced a 38.2% Fibonacci retrace of the entire move up. With that being the case, and the fact that the 94 handle has held a couple of times now, I believe that we are going to see support step into the marketplace right now. Unfortunately, there is no technical set up to start buying other than to put blind faith into the 38.2% Fibonacci retracement level. With that being the case, I will be watching this market closely, it probably on the daily chart in order to find an entry point. The 90 handle lines up nicely with the 50% Fibonacci retracement, and I believe that's as far as the Bank of Japan will while this pair to fall if the downward pressure continues.

AUD/USD

The AUD/USD pair had a positive week finally, closing well above the 0.95 handle. Unfortunately, the Friday candle is a shooting star so I suspect that this market is simply trying to consolidate around the 0.95 handle. This would make sense, it's a large, round, and psychologically significant number that will certainly attract a lot of attention. Nonetheless, I do believe that we go sideways for a little while, and a break above the Friday candle of course negates back, but I think more likely we will see a break below the weekly lows in order to continue falling. Many of the talking heads out there calling for 0.90 handle.

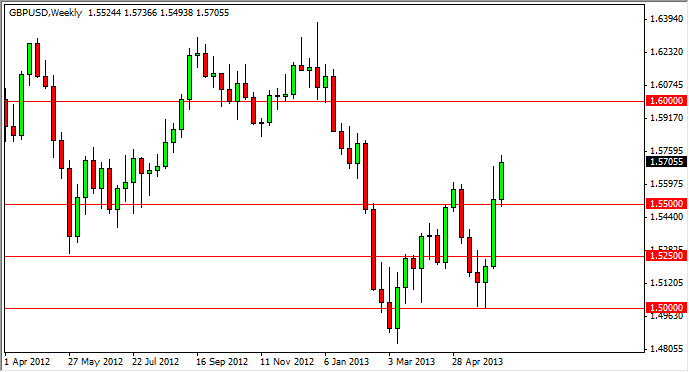

GBP/USD

The GBP/USD pair had a strong showing for the week, breaking above the highs from the previous week. Now that we have close above the 1.57 handle, I cannot help but think that we are heading towards the 1.6 handle eventually. Going forward, I believe that buying dips will be the way to go in this pair that is obviously broken out.