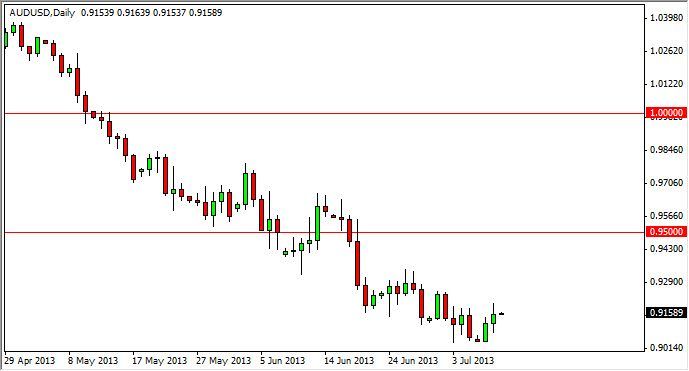

The AUD/USD pair had a back and forth session on Tuesday, but as you can see it did produce a positive candle. However, this candle really isn't much to write home about, and the way this pair is been going, any time that we see some type of support and bounce we have to be thinking about selling above. After all, the area that the market did find support was the 0.9000, an area that you would expect to see at least a certain amount of buying.

The Australian dollar of course is being hit by the fact that there is a bit of an Asian slow down, and on top of that gold has been absolutely decimated. Commodities in general have been ahead and the US dollar remains the supreme currency for the Forex markets. The bullishness that we may see in this pair is a simple opportunities sell above, and that's exactly how I am looking at it. I would love to see this pair go as high as 0.95 and produce some type of resistive candle, although I doubt we will even manage that. Personally, I think that the 0.93 handle is probably about as good as the buyers go for.

The 0.90 level is a major one, so it might take something to get through it.

Obviously, it doesn't get much more "big psychologically significant number" than the 0.90 handle. Because of this, I feel that this market is due for a bounce, as it has been sold off so drastically anyway. Going forward, I fully expect to see some type of resistive candle above that I can start selling, and I do think that we need to back up a little bit in order to produce enough momentum to smash through the 0.90 handle. Because of the fact that the level is so major, is probably going to take at least one pullback, if not more in order to get the inertia to break it down. As far as buying this market is concerned, I have aptly no interest in doing so at this point in time.