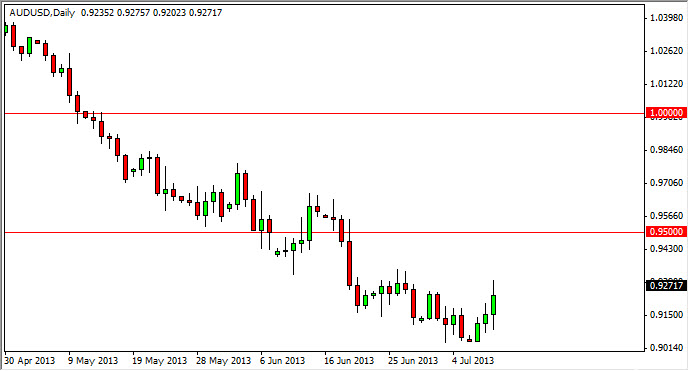

The AUD/USD pair had a positive session on Wednesday, as you can see we slammed into the 0.93 handle. This was predicated mainly upon the Federal Reserve releasing minutes from the last meeting, and showing that several of the members on the committee were concerned about the employment levels currently. Because of this, I believe that this market is ready to continue bouncing, but I still think that the 0.95 region will be far too resistance for the Australian dollar to continue higher.

That being the case, I think it's best to simply sit here and wait for the market to come back to me. I will sell a resistive candle in the general region, simply because the Australian dollar is far too levered to the Asian economies. Asia doesn't exactly look as strong as it once did, not to mention the fact that Chinese numbers haven't exactly been robust. Adding to that is the fact that the gold markets continue lower, and that of course has a massive effect on the Aussie as well.

Being patient will be the key

Being patient is going to be key in this marketplace as there are plenty of reasons to think that perhaps there will continue to be bullishness in this market right now. However, the trend is most decidedly to the downside, and I don't believe that the news that came out during Wednesday was necessarily trend changing. Rather, I believe that this news was more or less something to throw a bit of confusion into the marketplace, which of course works for the Australian dollar against the US dollar at the moment, but in the long-term I don't think that it will continue to do that.

The only way that I would consider buying this market is if we got above the 0.97 level, and I don't necessarily think that's going to happen anytime soon. After all, it is the summer season, and as a result most of the large players are out of the market right now anyways. If we did get that move though, I couldn't argue the marketplace I would have to be long of the Australian dollar at that point in time.