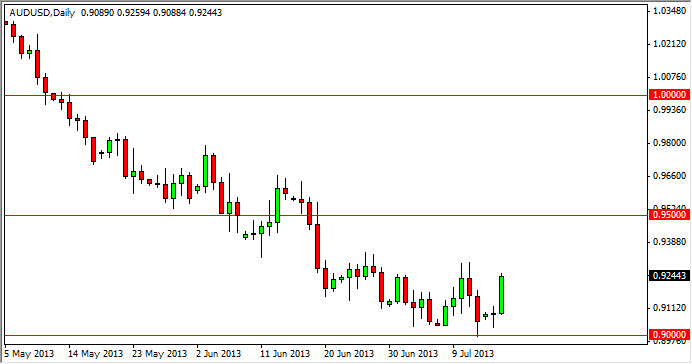

The AUD/USD pair had a very strong showing on Tuesday, breaking the top of the somewhat supportive Monday candle. This is a huge surprise to me though, the 0.90 level is as big as it gets as far as "big round numbers." However, I think that this market is doomed to continue its very short run, although not at the moment.

The fact that we close towards the very top of the candle for the session suggests that there will be a little bit of follow-through. Quite frankly I am bearish of the Australian dollar, but I welcome that turn of events as it will simply allow me to sell this market at a much higher price. I think that the 0.95 handle will certainly be a bit much for the market to overcome, and because of that we will more than likely see some type of resistive candle in the general vicinity that should serve a nice selling opportunity.

Top of consolidation

We have however been consolidating at its lower levels for some time. It appears that the 0.93 level is the top of the more recent consolidation that we've seen, so there is the possibility that it holds the buyers back. It's because of that that I will check the daily candle in order to see something along the lines of a shooting star, which of course would have me selling from the general vicinity. As for buying, I have absolutely no intention in doing so because the Australian dollar is so heavily leveraged to Asia. With Asian economies looking week, I have no interest in trying to take advantage of that correlation at this point.

Going forward, I don't think we can do anything in this market until we get above the 0.97 as far as buying is concerned, and because of that I think that the Australian dollar will be a "sell only" market going forward. I have a hard time believing that that's going to change, at least anytime soon. With that being said, I am selling at the first signs of resistance.