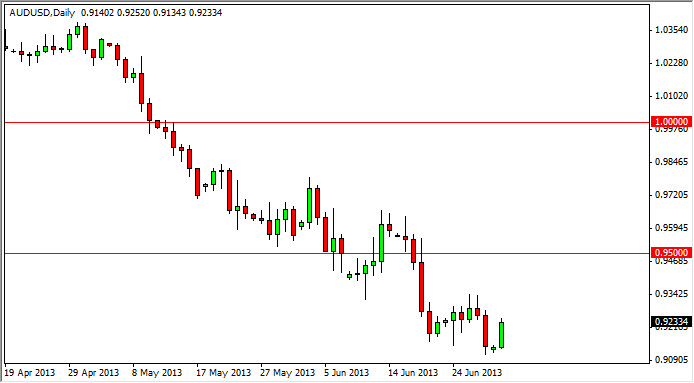

The AUD/USD pair had a positive session during the day on Monday, but as you can see is starting to come up with two significant resistance. I see resistance at 0.93, and then naturally of the 0.95 handle. Because of this, I don't think that this sudden bullishness is anything that I want to be involved with, but it does give me a "heads up" on the possibility of selling the Australian dollar at a higher level. Quite frankly, the Aussie dollar should continue to weaken as the situation in Asia demands less and less commodities going forward.

With that being said, the 0.95 level is also a large round psychologically significant numbers that should attract sellers, and there is a cluster of trading right around that vicinity anyway. In fact, it isn't until we clear the 0.98 handle that we can possibly see a significant shift in momentum, which at that point in time I might be enticed to start buying.

Gold markets push higher, so does the Aussie

The Monday markets did see the gold markets rise over $30, and this of course pushes the Australian dollar higher as well. However, that market looks like it's heading towards a significant amount of resistance above, which lines up fairly neatly with the Australian dollar as well. We still believe that the US dollar will continue to reign supreme over the longer term, so any bounce at this point in time is simply going to be an opportunity to buy the US dollar on the cheap. That being the case, I am being very patient in this marketplace and waiting for that resistive candle in order to get involved.

This is the case with all commodity currencies at the moment, with the Australian dollar be in a particular favorite with the sellers out there. The New Zealand dollar looks back, but not as bad as this particular market. Because of this, I feel that the Australian dollar will continue to be the favorite "whipping boy" of hedge funds out there as they express pro-dollar and negative commodity viewpoints.