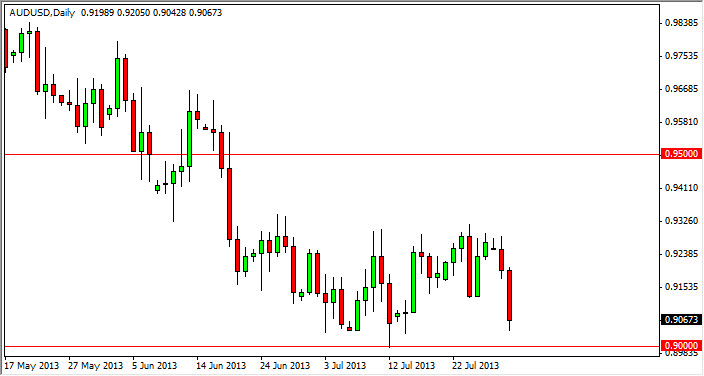

The AUD/USD pair fell drastically during the session on Tuesday, aiming towards the 0.90 handle. This is an area that has been supportive in the past, and as a result I think it is a very important "line in the sand" for any buyers of the Australian dollar. Quite frankly, I can see no reason why you would want to buy the Australian dollar unless of course the Federal Reserve suggests later today that it is going to push back any potential tapering off of quantitative easing. In that particular circumstance, the US dollar will get absolutely pummeled as commodities go much higher.

Also, you have to keep in mind the gold would skyrocketed that point, and this would certainly bring up the value of the Australian dollar in the process. However, we can't anticipate something like that, and quite frankly it's not expected. Going forward, I believe that the 0.90 level will more than likely be broken down, and at that point time I would expect that the Australian dollar to start heading to the 0.85 handle, which is the next significant psychologically important support level.

Negative bias, consolidation over the last several weeks.

This pair has had a fairly negative bias over the last several weeks, and because of that we feel that the market will eventually break down. Quite often, what you'll see is a grinding against the specific level like this, and then a serious meltdown. That of course could be because of the Federal Reserve, but they have been known in the past to give the markets and the banks exactly what they want. Markets and banks of course don't want the Federal Reserve to start tightening, because it takes away easy profits. However, the economy has to eventually work on its own, and quite frankly it's time to stop nursing it along.

That being the case, if the Federal Reserve looks like it's ready to implement a tapering off of quantitative easing, expect this pair to break down below, and go much lower over time.