By: Andrew Keene

GDP growth in Canada has been very slow recently, and this in conjunction with signs of slight inflation from rising industry prices are negatively impacted the CAD. Also, the news about US Federal Reserve tapering its bond-buying continued the downslide for the Canadian “loonie.” The Canadian dollar accounted for 1.57% of the $6.05 trillion in foreign-exchange reserves in the first quarter according to the International Monetary Fund. Other various economic reports such as the .7% decrease in crude oil prices and the rallying US dollar contribute to the CAD’s deterioration.

Canada’s economy has not underperformed the US economy since 2006, and this trend is predicted to continue for at least the next three years. Canada expects 1.7% economic growth for 2013 (US – 1.9%), 2.4% for next year (US – 2.7%), and 2.75% for 2015 (US – 3%) according to Bloomberg studies. The Canadian dollar declined about 1.4% for June, 3.3% for the quarter, and 5.7% for this year, and CADUSD ratios in recent months have fallen almost as low as those back in October 2011. The weakness of the Canadian dollar leaves the currency open to be “driven by global trends and sentiment…and the general outlook of the US dollar” according to Canadian economists.

The current CADUSD ratio is at 0.9522 with the CAD up 0.22 from yesterday’s closing at 95.61. YTD the currency is down 2.44%, and Canadian officials say that economic recovery will require “stability and patience.”

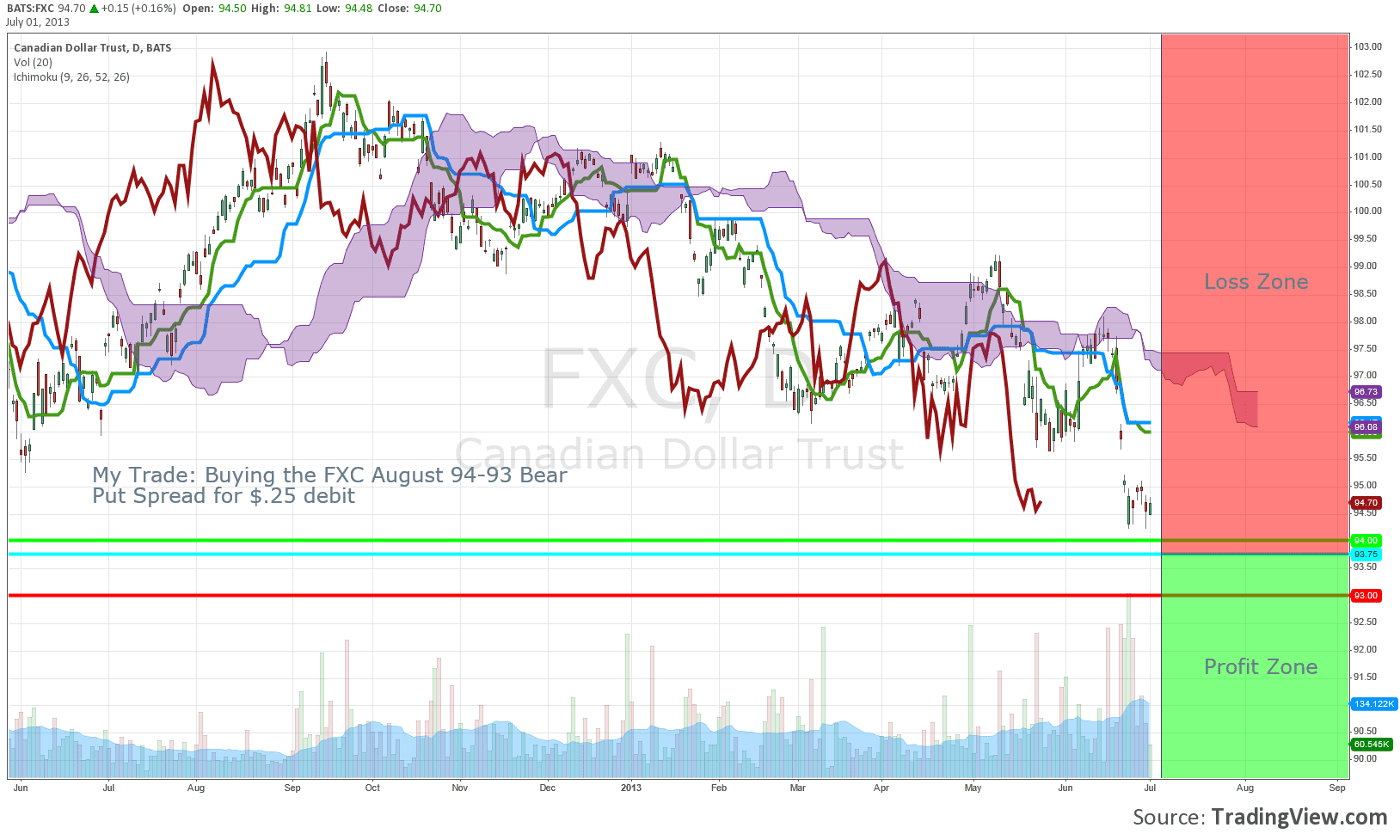

My Trade: Buying the FXC August 94-93 Bear Put Spread for $.25 debit

Risk: $25 per 1 lot

Reward: $75 per 1 lot

Breakeven: $93.75

Reward to Risk Set-Up: 3:1

Greeks of this Trade:

Delta: Short

Gamma: Long

Theta: Short

Vega: Long