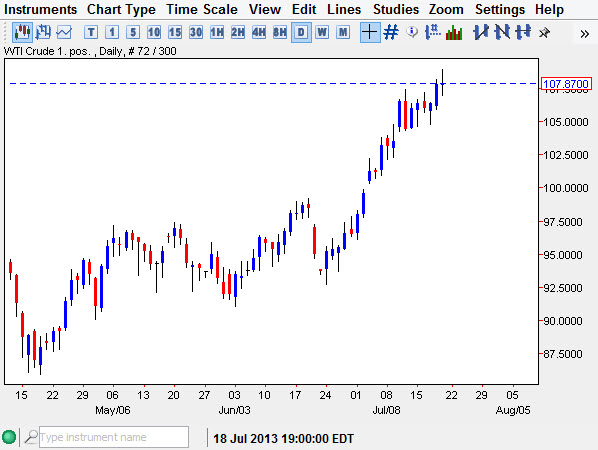

The WTI Crude Oil markets had an interesting session on Friday, as we continued to try and grind higher, but fell short and ended up earning a pretty substantial shooting star. The biggest problem of course is that I see quite a bit of support all the way down to the $105 level, so it's difficult to start selling at this point. However, options markets may offer the alternative events I am looking for when it comes to shorting this contract that I think is gone way too far, way too quick.

The reason I am choosing options to do this is simply that I'm only risking a set amount of money ahead of time. We may still have some bullishness going forward, so I will probably look for a weekly option or something to that effect to see if I can get a strike price below the $107 handle. This is one of those situations where the payout will more than likely be much larger than the money being risked.

Parabolic markets end poorly

Parabolic markets tend to end very poorly, and that's exactly what this one is. In fact, we have seen it in the oil markets before as headlines drive prices as opposed to supply and demand. Eventually, supply and demand really is what will move the market over the longer term, and therefore we have to wait and see how things play out. However, I do think one of the best trade will be shorting this ridiculous move higher. The question then becomes when exactly can we do it?

On the other hand though, I do recognize that the market could break the top of the shooting star, and that's a very positive sign. I still think that the $110 level offers significant amount of resistance based solely upon the fact that it is a large round number. This could attract sellers as well, so at this point in time I'm very hesitant to start buying simply because there are too many possible headwinds above current price levels. Going forward, I will be using options, simply because it is the safest way to go about this type of market.