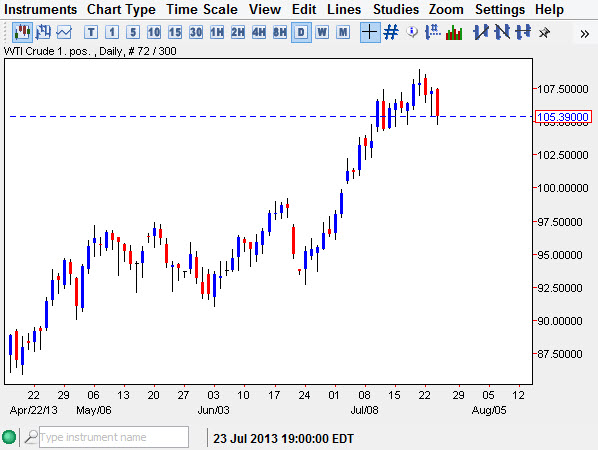

The WTI Crude Oil market as you can see fell during the session on Wednesday, plunging down towards the $105 level. This is the bottom area of the most recent consolidation though, it appears that the sideways action should give the "pause that refreshes" to the uptrend. However, this will be predicated mainly upon headlines coming out of Egypt, and more importantly headlines coming out of the Federal Reserve.

The Federal Reserve is thought to be waning the options as far as tapering off of quantitative easing in the month of September. There were good economic numbers coming out United States during the session on Wednesday, and as a result the US dollar got a little bit of a boost as traders started to worry about the tapering happening again. If that's the case, commodities in general will lose out against the US dollar, and of course this market is no different.

Remember, oil is priced in US dollars.

The oil markets are priced in US dollars, and this is exactly why the two markets typically run in an inverse fashion. It's not that the Dollar and the price of oil can go up at the same time, but typically they don't. That being the case, a lot of people use this contract as an "anti-dollar" play.

I believe that's what's been going on for the most part, and the headlines coming out of Egypt have simply been some type of excuse. It's ridiculous to think that oil is going to stop flowing, regardless of what the Egyptians think they will do with the Suez Canal. There are far too many nations out there willing to open the canal for them if they tried, with the U.S. Navy being number one in that list.

Going forward, if we can break down below the $104 level, I think we will go down to $99 in relatively short order. Look for the $110 level above to be rather resistive, but I would be willing to buy a supportive candle in this general vicinity for a short-term long position.