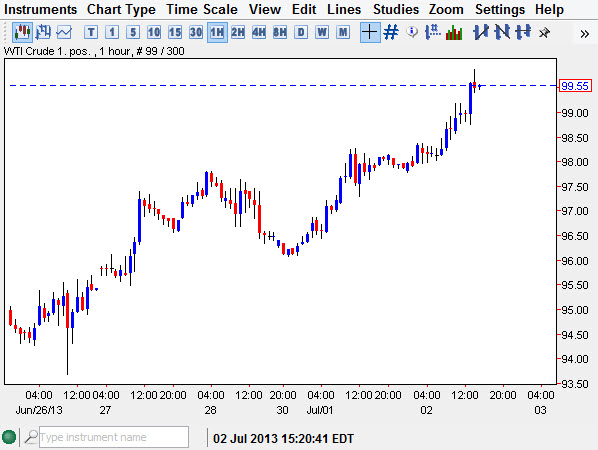

The WTI Crude Oil markets had a strong showing during the session on Tuesday, smashing into the 99.50 level with great conviction. However, we are still below the all-important $100.00 handle, an area that should provide psychological resistance at the very least. Because of this, I still am hesitant to buy into this market, and as a result I also question the timing of this move as many traders will be going home for the holidays in the United States. Part of this simply could've been a bit of a short covering after all.

There will be electronic trading over the next couple of days, but as far as real volume, I wouldn't expect much simply because of what the magnitude of the Independence Day holiday is in the United States typically drags just about everybody out of their office, oil traders included. Because of this, I am simply leave in this market alone, or possibly shorting it even though there is a significant amount of bullish action over the last 24 hours.

This market could be a bit tricky over the next several sessions.

This market will more than likely see a lot of a radical movement, discipline because of the lack of liquidity. This will be the case until at least Friday, and even then there will be only a certain amount of Americans involved, which of course is one of the larger markets for oil in general. Because of this, I have a one hour chart posted with this contract, showing what happened at the end of the session.

The shooting star that formed at $99.50 of course is significant to me simply because it shows that we did not have the strength to breakout, and more importantly started to selloff at the end of the session. With that being the case, I believe that the short covering may have propelled this market a little bit artificially, and as a result I am willing to take a shot at shorting this market below the $99.25 handle. I would only risk about a dollar for the stop loss, but do see downside potential of about three dollars.