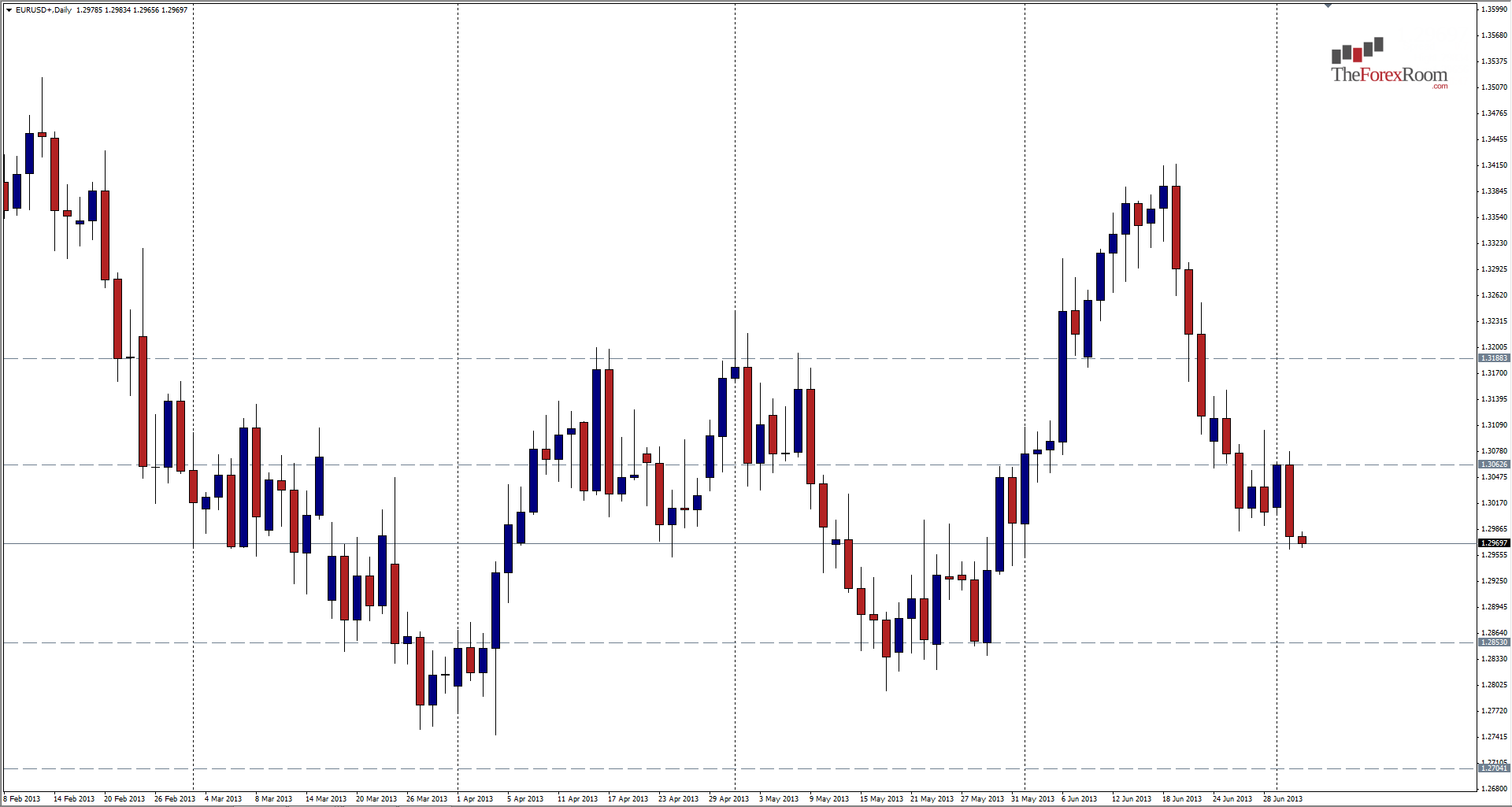

The EUR/USD is clearly in a downtrend. A downtrend that most recently began when a bearish engulfing candle formed on the daily chart June 19. This was the candle that started and confirmed the bearish trend we have been in for the last 2 weeks. Yesterday, the pair printed another Bearish Engulfing Candle on the daily chart after spending some time hovering around, and trying very hard to close back above 1.3050. This level is a key support & resistance zone for the pair and held the pair captive for at least half of April and again in May. Now it is acting as resistance with yesterday’s high hitting 1.3078 early in the London Session before falling to close at 1.2963. S/R zones are plentiful for this currency pair between 1.3200 and 1.2800 with a daily zone sitting just below yesterday’s close at 1.2960. Breaking this level should take little effort now and drag the EURO down to around 1.2850 where the next daily support zone sits. Below that, I will be watching the 1.2750-1.2700 level very closely. I have no doubt that the Greece deadline is weighing on the EURO, but we have plenty of other fundamentals in the next 3 days that could affect prices, so be careful out there. Helmets and pads people!

Happy Trading!