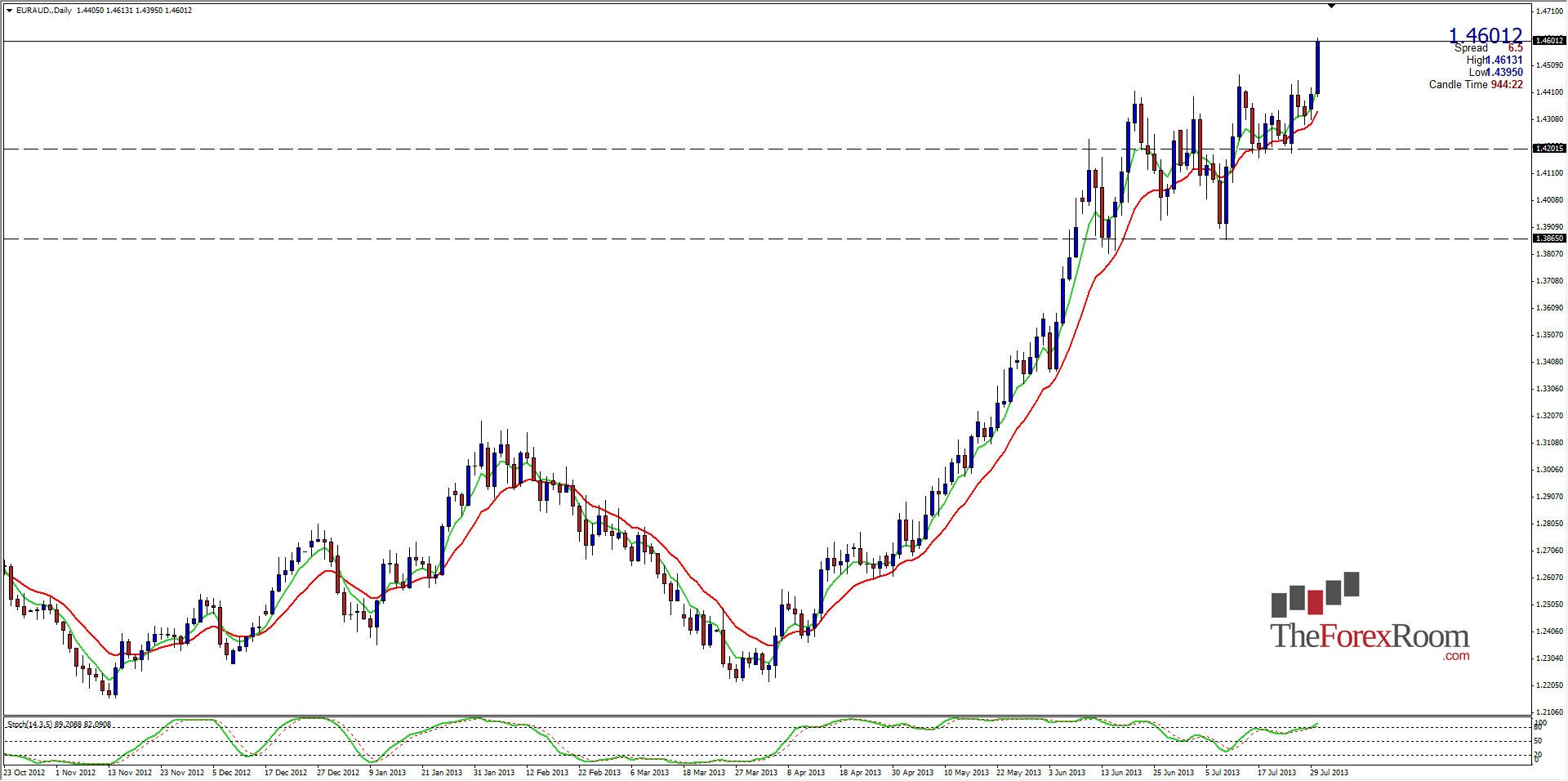

Last Thursday (July 25) I wrote that the EUR/AUD was setting up to continue its bullish run above 1.4500 after finding support at 1.4200. In the last 3 days the pair went into consolidation and printed 3 very small daily candles. This was because traders were waiting for today’s Building Approval numbers and a speech from Gov Stevens. Building Approvals was the catalyst for further AUD weakness with the numbers falling from the previous -4.3 to the current -6.9...this is significant because they were predicting a positive 2.2 and instead saw a further decline in Building Approvals and the AUD fell dramatically as a result. Now, we have a busy week of further key fundamentals with several medium impact announcements pertaining to the EURO today. Fundamentals aside, the pair looks extremely bullish at this point and is trading at 1.4612 at time of writing. We literally have no further resistance on this pair until we hit the highs from May 2010 at 1.4890 and lows from the year 2000 at 1.4990. Last week’s highs at 1.4475 will now become the key level of support.

Happy Trading