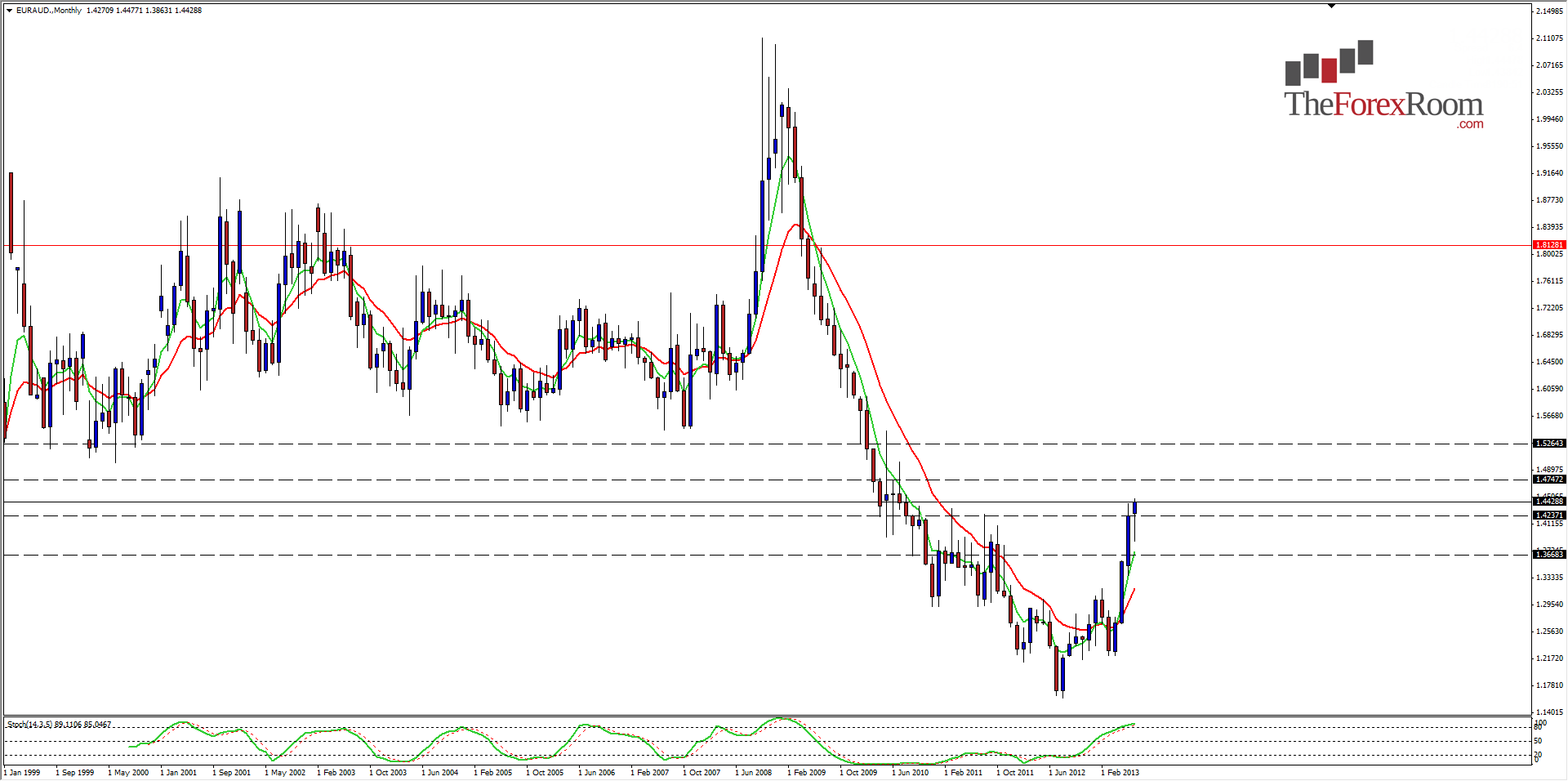

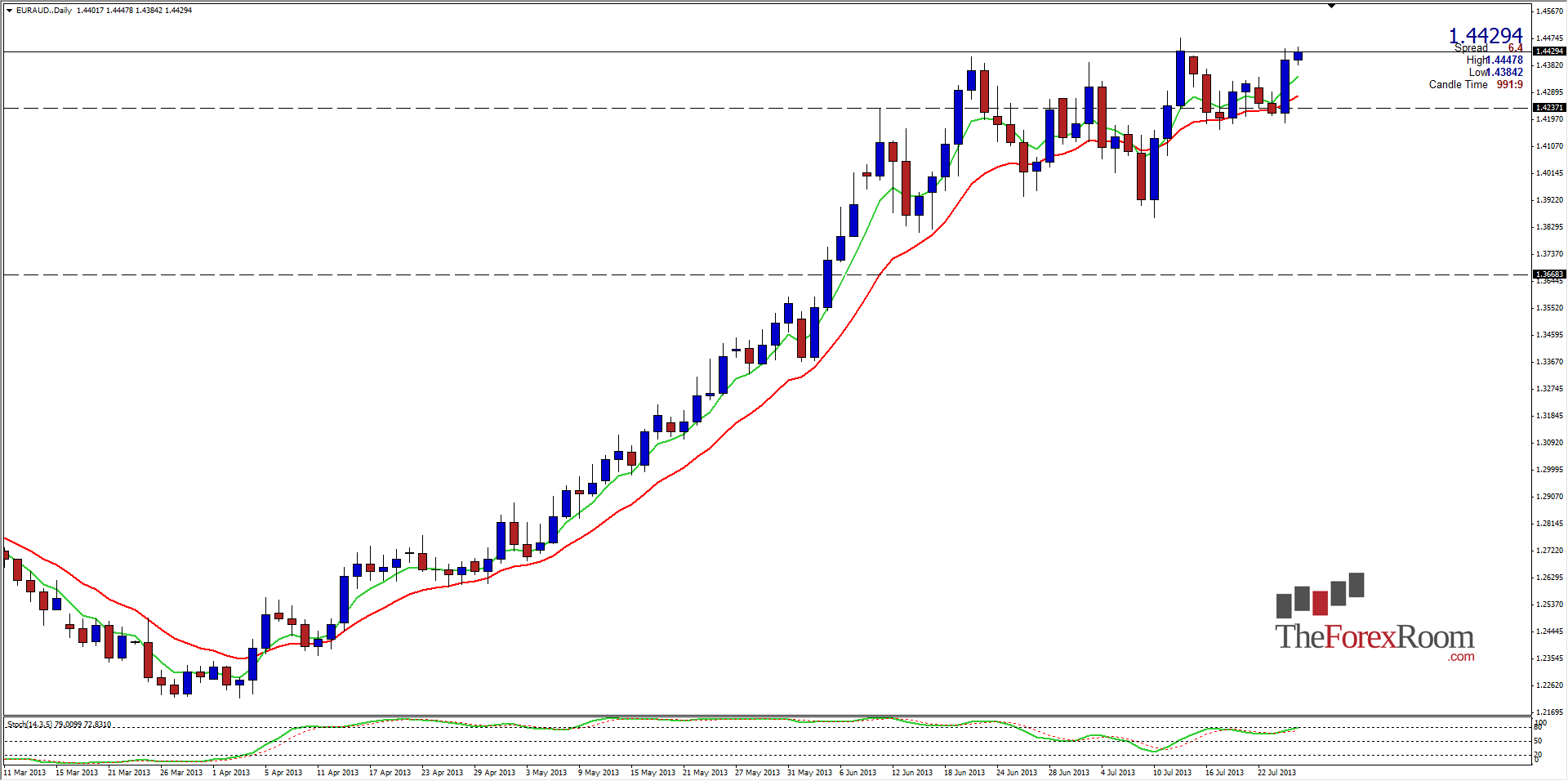

The EUR/AUD pair has been climbing since the end of March/early April of this year when the Australian Dollar began to weaken and began its bearish trend. The result of the continued AUD weakness is the bullish trend we see on the EUR/AUD with the EURO gaining traction on the weakening AUD in the process. The pair has found support at 1.4200 it seems and yesterday printed a 200+ pip Bullish Engulfing candle on the daily chart. This is potentially the beginning of further bull running's as resistance is scarce above 1.4500 leading one to the conclusion that there are at least 600 pips that this pair could climb further before hitting the first hurdle at 1.4990. In order to see this possible resistance, we have to go back 13 years to June 2000. More recently we have lows from October and November 2007 at 1.5495. That’s a long way up there and we could see this becoming the next candidate for a bullish run not seen since Abe announced his plans for the Yen. There is some minor resistance at 1.4500, but the bulls have taken a break, gathered strength and appear to be ready to take on this challenge very soon. The bears will have their work cut out for them if they want to take back control, only a daily close back below 1.3860 will open the door for a fall back to 1.3190 with a minor bump in the road at around 1.3540.

EUR/AUD Keeps Climbing

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/AUD