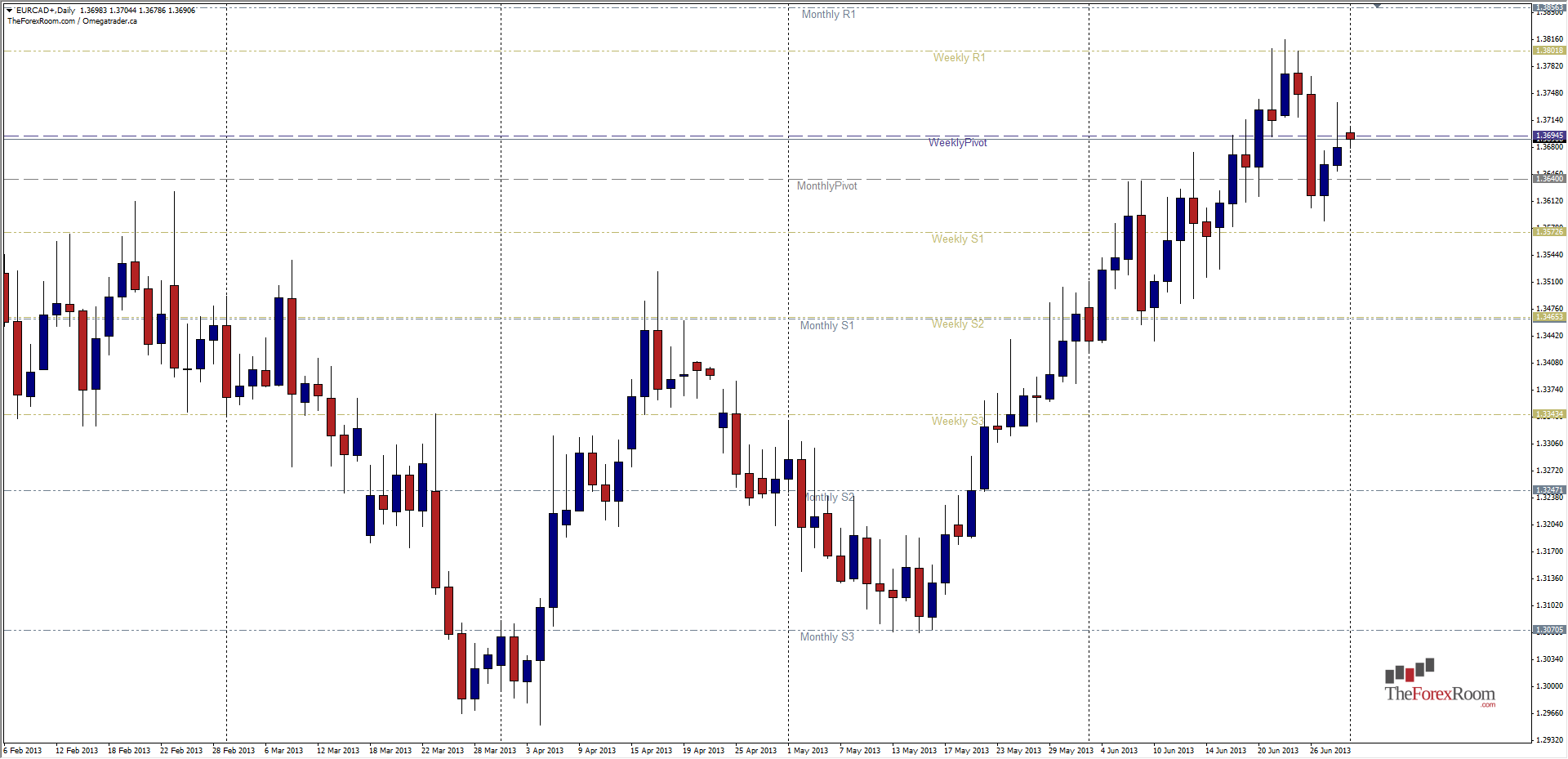

The EUR/CAD has been ascending in a Daily channel since the middle of May, and at a fairly steep angle. The pair has now broken the channel to the downside, but it has also attempted to do this earlier in June and failed. Now we have another potential reversal from a solid resistance level at 1.3700. Price turned bearish at 1.3800 and within 2 days fell 200 pips to 1.3600, retraced 50% of that move to the Weekly Pivot and printed a bearish pin bar reversal on Friday. After gapping up at the market open, the pair is now falling, as the Asian session draws to a close but will need to break below 1.3650 in order to have any chance of falling further. Support is frequent and includes a Daily S1/Monthly Pivot at 1.3640, Daily S2 at 1.3600 and Weekly S1 at 1.3575. Resistance is strong between 1.3700 & 1.3800 with a Daily R1 at 1.3725 and Daily R2 at 1.3775 to hinder the bulls continued advances. While looking bearish now, it is only Monday and any moves made today could be reversed on Tuesday! Also, we have a busy week for fundamentals and a bank holiday in the USA July 4th.

EUR/CAD Daily Outlook - July 1, 2013

By Colin Jessup

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Colin Jessup

Colin Jessup is certified in both Securities & Technical Analysis from the Canadian Securities Institute, founder of Omegatrader Canada and a Live Trading Coach at TheTradingCanuck.com, a service that calls live trades to captures dozens of pips daily with low drawdown. - Labels

- EUR/CAD