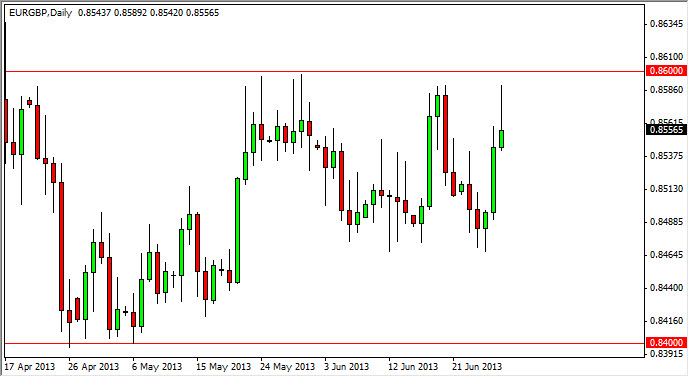

The EUR/GBP pair rose during the session on Friday, but as you can see the 0.86 level continues to offer far too much resistance. It's kind of ironic, because several weeks ago I was complaining about how difficult this market is to trade, simply because we are struggling any 200 PIP trading range. Since then, we found ourselves trading in a 100 PIP trading range!

The resulting shooting star from the session on Friday suggests that we are going to continue to bounce around in this area, so I think there is a short-term trading opportunity at this point in time. I would expect this move to get far below the 0.8480 level, but it is good for short-term gain of a bounce 60 pips or so.

It's consolidating until it isn't.

I get a lot of questions from people who are trying to learn how to trade as to when you can tell whether or not a consolidation area is going to continue. The simple answer is this: It simply works until it doesn't. Think of it this way, when you place a trade you are risking a certain amount of your trading capital to find out information. That information is something that you can capitalize over the long-term, and as a result sometimes you realize a gain right away, sometimes you lose that money only to turn around and make more later because of that knowledge. That's essentially how I look at this situation, as it should work until it doesn't, and when it doesn't and I lose some money playing this range, I now know the direction of the market and which way I want to go for the longer-term trade. It's essentially what I've been doing in this pair, and now it appears that we are not quite ready to make a serious move, and even if I did get stopped out above the 0.86 handle, I would not only be bullish because of the breakout above the resistance level, but also the fact that we sliced through several shooting stars. At that point in time, I would not only be bullish of this market, but I would be aggressively so.