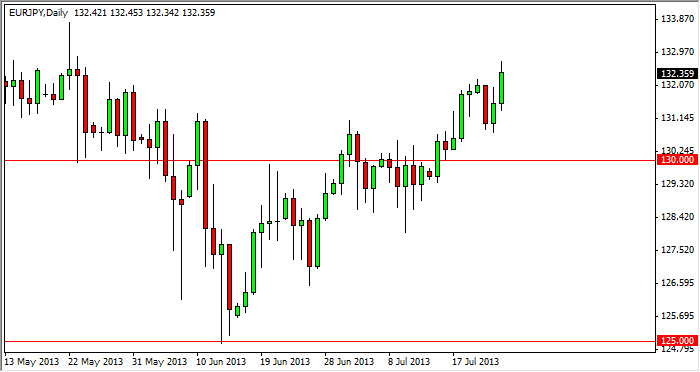

The EUR/JPY pair rose during the session on Wednesday, and broke above the 132 handle again. This market has been bullish for very long time, and it appears that we are essentially trying to trade some type of bullish channel. On top of that, the Bank of Japan continues to work against the value of the Yen, which of course gives me reason enough to buy this market anyway.

I see the 130 level as a potential "floor" in this marketplace, and as a result I will be buying pullbacks all the way down to that level. On signs of support, even on short term charts should be considered buying signals. Just above though, I do recognize that there is a significant amount resistance at the 133 handle, so it's possible that this pullback will simply be in order to get enough momentum to push his market higher.

Don't fight the Bank of Japan

The Bank of Japan has a much larger account than you do. Because of this, it's wise not to get in their way. They do not like the Yen being valued so high, and quite frankly even though we see a massive melt up in this pair, it is still historically low.

I think that if the 130 level gets broken to the downside, the Bank of Japan will notice. It most certainly will get involved if we get as low as the 125 handle, and I think a great long-term trade is available down there. Nonetheless, there is enough support between here and there that you should be thinking "long only" anyway. There is aptly no reason to be trying to risk shorting this market, because if you want to short the Euro you could do it against the US dollar.

On the other hand, we could get a solid break above the 133 handle, which is enough to get me buying this market as well. Essentially I do not have a scenario where I'm selling this pair, it's only a matter of where I am buying it right now.