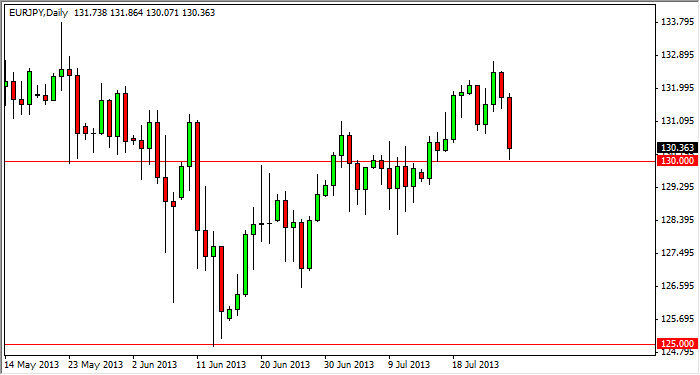

The EUR/JPY pair fell hard during the Friday session, slamming into the 130 handle. This level has been significant over and over in this currency pair, as you can see just a couple of weeks ago was significant resistance. What I find most interesting about this level is that there are so many hammers formed just underneath it, I feel that it's almost impenetrable.

The Bank of Japan continues to work against the value of the Yen, so I don't think I will be shorting this pair anytime soon. That being the case, it is a "buy only" type of marketplace, and as a result I am looking for that supportive candle to start buying. If you are little bit more aggressive though, you could make a serious case for just simply buying at this level.

Watch the equity markets

This pair typically will follow equity markets in general around the world. If the stock markets are doing fairly well, this is a "risk on" scenario, and that should push his pair higher. On the other hand, if stock markets around the world begin the selloff, this pair typically will fall. However, I do believe that there is enough noise between here and 128 that following will be met by a ferocious buying.

I think that this pair will eventually go to the 133 handle over the course of the next several weeks, and as a result this is a decent medium-term opportunity. However, I believe this market will go much higher over the course of the rest of the year, and as a result I think it's a long-term buy regardless. It really comes down to your timeframe, but if you are a longer-term trader, there is aptly no reason whatsoever to be short of this market, and plenty of reasons to be long.

That being said, I believe buying pullbacks work, as do breakouts to the upside. I see aptly no scenario where I would short this market, and I believe that the "floor" in this marketplace is the 125 handle. If the market goes below there, I believe the Bank of Japan would probably get involved