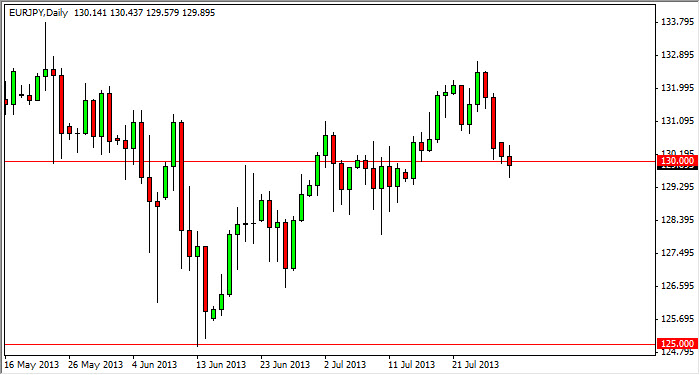

The EUR/JPY pair fell during the session on Monday, testing the 130 support level yet again. However, you can see that the markets essentially printed a neutral candle, and as a result I think this is very telling as we should see continued support in this general vicinity. Not only that, but you can see that there are several hammers that were formed previously in this general vicinity, so I see a massive support range all the way down to the 128 handle.

On top of that, the Euro looks like it might be trying to breakout against the US dollar. That will have a positive effect on this pair as well, and at that point in time we really could see a bit of a "melt up" in this market. Because of this, I think that if the Euro breaks out against the US dollar, this might actually be the market you want to be in longer-term.

This pair tends to follow global risk

This pair tends to follow global risk appetite, and it generally will move with global stock markets. There is no direct correlation, but is more or less a "feeling" that this market gets when it's all good around the globe. Because of this, keep an eye on the stock market as a general "barometer" on how things are going as far as traders and their overall feeling of the markets. The better they feel, the better this pair performs.

Going forward, I fully expect this area to offer enough support to push this market higher, and I do expect to see the 133 level fairly soon. Beyond that, I would not be surprised at all to see 135, and possibly 140 over the next 6 to 8 months. If we do see a bit of a breakdown in this marketplace, I fully expect to see the 125 level to be almost impenetrable. Remember, the Bank of Japan will be paying attention to the value of the Yen against the Euro and the Dollar, and tend to move in concert when it comes to working against both of these pairs and any type of massive fall.