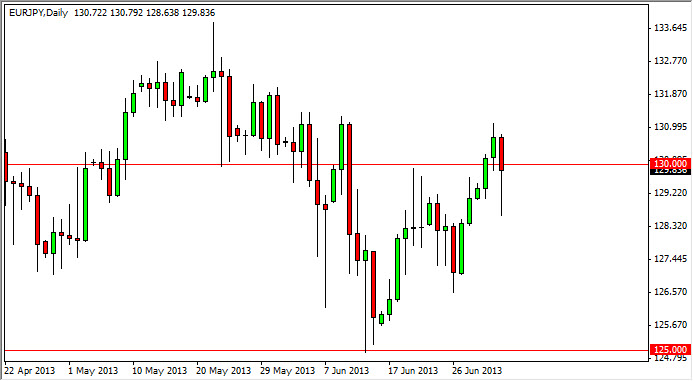

The EUR/JPY pair fell during the balance of the session on Wednesday, as we even went as low as 128.50 during the session. However, we did bounce significantly from that level, and 40 massive hammer that is based on the 130 level. The 130 level has been a very important level on this chart several times now, and as a result it does not surprise me to see support come into this marketplace, and I think that if we can break higher, we will more than likely target the 131 handle, and then possibly the 133 level.

The Bank of Japan continues to try and weaken the Yen, through quantitative easing, via bond purchases and possible ETF buying. That being the case, the Yen should continue to weaken against most currencies, and as the Euro has formed a hammer against the Dollar for the session, it makes complete sense that this market would bounce or continue higher. Alternately, I believe this market goes much higher, but of course there are going to be choppy bits here and there as the market will have to chew through certain resistant areas.

This pair tends to be very reactive to the nonfarm payroll number

The nonfarm payroll coming out on Friday of course would have a massive effect on this pair, as the Yen generally reacts very strongly to it. Although it doesn't necessarily make sense considering that the Euro and the Yen are featured in this pair, it does tend to be a "risk on, risk off" type of market, and as a result will rise with positive sentiment around the world's indices.

Going forward, I think that the 133.50 level will have to be overcome to continue higher, possibly to the 135 handle in relatively short order. This market will go a lot higher than that eventually, and based upon longer-term charts I still believe that we will look at the 150 level before it's all said and done. Because of this, I continue to buy pullbacks in this marketplace just like the one that we saw for the Wednesday session.