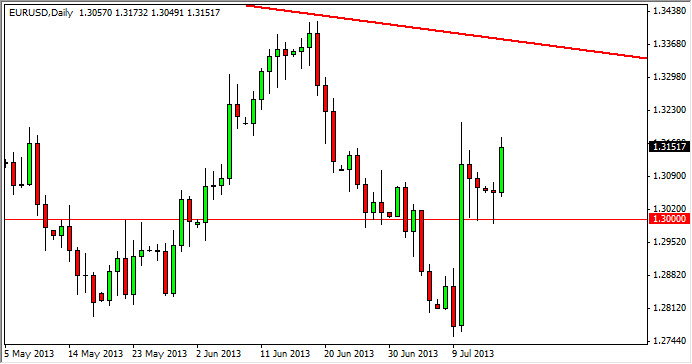

The EUR/USD pair rose during the session on Tuesday, breaking the top of the three previous hammers that have shown so much support in this market. The 1.30 level continues to offer significant support, and quite frankly I've been surprised at how long it's taken for this market to go higher. After all, you don't see triple hammers very often, and they are normally very strong buy signals.

That being the case though, I do see that there are some potential problems ahead. The 1.33 handle is roughly where the downtrend line from the weekly chart is slicing through, and that of course signifies that the market will more than likely turn in that general area. Because of this, I think that we have a double trade coming up. We will see bullish action shortly, and therefore the shorter-term traders will more than likely be buying the Euro, while the longer-term traders are simply letting this market come back to them near the 1.33 handle in order to start selling it.

Headline driven and quite obnoxious

I've absolutely hated this pair for two years. Most of the professional traders I know have pretty much given up any sense of normalcy with this pair, and as you can see every time there is a headline out there, it seems move the market in drastic ways. The European situation has not been taken care of as far as they are concerned, the markets take turns deciding whether or not they want to focus on that, or quantitative easing in the United States. Because of this, it's been very difficult to trade this market and as such I tend to wait until the larger trades appear, such as shorting at the 1.33 handle if we get the right resistive candle.

On the other hand though, that's not to say that short-term traders can make money. In fact, I know several people that are but I don't have the inclination to sit in front of the charts all day. It really comes down to your risk tolerance, but I personally feel more secure selling this pair at a higher level.