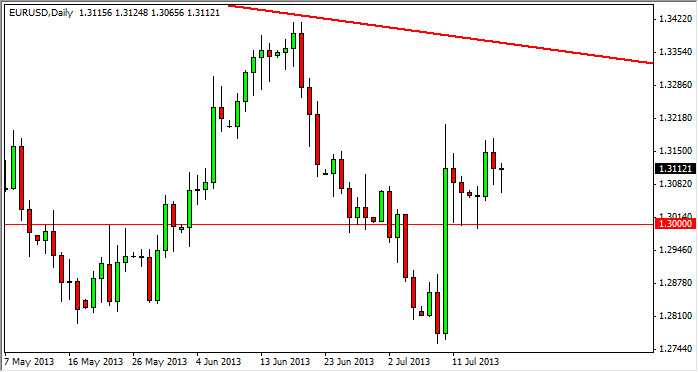

The EUR/USD pair fell during the balance of the session on Thursday, but as you can see got enough of a bounce in order to form a hammer. This market has formed several hammers over the last week, and because of this I think it's obvious that the market is going to attempt to go higher. Quite frankly, I'm kind of surprised that it hasn't done it already as the Federal Reserve Chairman Ben Bernanke testified over the last two days as to the fact that the Federal Reserve may not be able to taper off of quantitative easing in the month of September like so many and the market believed.

However, when you think about it the Euro has plenty of problems of its own. This is essentially an argument between two very sick currencies for very different reasons. However, I see that the downtrend line above from the weekly chart is hovering right around the 1.33 handle, and because of that I do not think that this market will go above that area.

Two speed market

I believe that the EUR/USD is essentially a two speed market at the moment. This is because in the short term, you can certainly see that there is a lot of support below, and that the markets will more than likely try to push higher. However, if that downtrend line holds from the weekly chart, we have a sell signal not too awfully far above where we are right now.

What's even more interesting is the fact that on the longer-term charts, it appears that we are trying to form some type of the ascending triangle that has a base at the 1.28 handle. Because of that, I believe that the longer-term traders are going to be looking to push this pair down again, and if they can break down below that level, we really could see this pair break down significantly. I don't know that that's going to happen during the summertime, but I would not be surprised at all to see that later this year, especially if the Federal Reserve does in fact begin to taper off of quantitative easing.