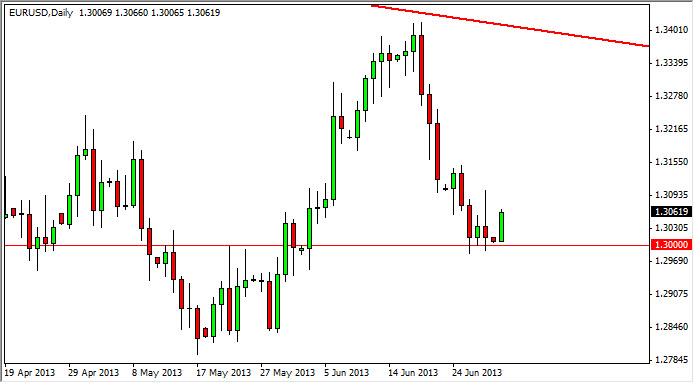

The EUR/USD pair rose during the session on Monday, showing the 1.30 level to be supportive yet again. This being the case, it appears that the level will continue to have an effect on markets, and with that being the case, I believe that the 1.30 level will be a bit of a magnet for price, as it is essentially "fair value." This is because the overall market seems to see support at the 1.28 handle, and perhaps resistance somewhere around the 1.32 handle.

On top of that, there is a downtrend line from the weekly chart somewhere near the 1.34 level at the moment, so even if we do get a bit of a breakout, it's probably going to be somewhat subdued. Also, let us not forget how strong the US dollar has been recently, and quite frankly there's no reason to think that's going to change anytime soon. Although, having said that the US Dollar Index does look like it's ready for a slight pullback as it has been somewhat parabolic lately.

Central banks will still continue to control this pair

The European Central Bank and the Federal Reserve continue to be the main drivers of this particular market, simply because the Federal Reserve may or may not be pulling back from quantitative easing, and that of course puts upside pressure on the Dollar. On the other hand, you have the Euro, which represents an area of the world that is having a lot of financial issues at the moment. With that being the case, it makes sense that eventually the Dollar will continue to strengthen simply because there is a stronger economic condition in the United States than mainland Europe.

If we do manage to get below the 1.28 handle, that would represent a significant breakdown in the Euro, and we could really start to pour on the downside pressure. However, I believe that we are going to see a bit of a rally from here, but somewhere near the 1.32 level we should see resistance come back into play. On that resistive candle, I would be more than willing to sell this pair.