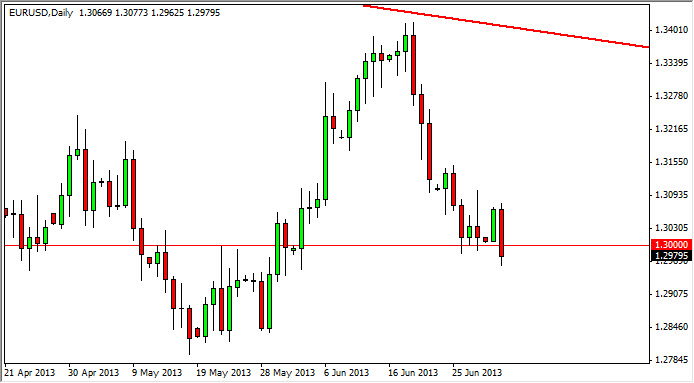

The EUR/USD pair fell hard during the session on Tuesday, not even giving us the significant bounce that I had anticipated. Because of this, it looks like this market is weakening of that, but in reality we are still close enough to the 1.30 handle in order to consider the area still valid. That being said, I am not willing to risk any money in this market at this moment in time simply because it seems to be gambling at best.

Adding to the concern with a market like this is the fact that the next two days will be very thin trading out of the United States, with many brokers not even bothering to open up during the July 4 session itself. Because of this, I feel that if you want to play the Euro, it's probably best to play it against other currencies at the moment. This market is a complete mess at this point in time, and trading it for anything more than a quick scalp is going to be almost impossible with the way it's been behaving.

Federal Reserve and European Central Bank are the only two things that matter

The Federal Reserve and its perceived tapering of quantitative easing later this year will be a major driver of this pair. The biggest problem of course is the fact that the 1.28 level below is massive support, and until we break down below it, there is no clear path lower. Any breakdown at this point time will be difficult, and will be more grinding then falling. On the other hand though, going higher is going to be a bit difficult as well as there is obvious pressure to the downside. Simply put, something has to give, but I wouldn't be surprised if it didn't give until summer is over. Because of this, I am waiting to see a break down below the 1.28 handle at this point in time in order to sell, or would be interested in selling closer to the 1.32 handle. In the meantime, I simply will play the Euro against the Pound, which is a much clearer currency pair at the moment.