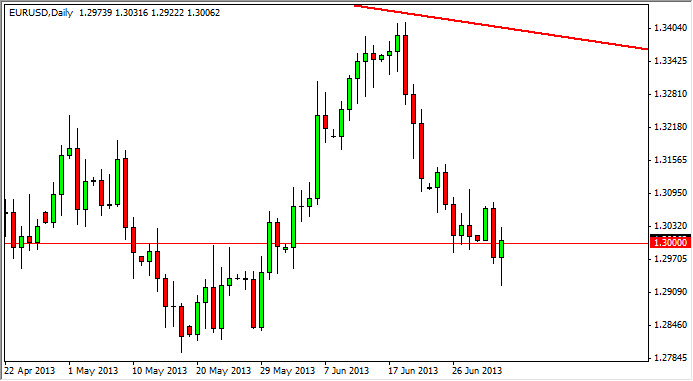

The EUR/USD pair fell during most of the session on Wednesday, getting as low as 1.29250 one point during the session. This market bounced from there though, and formed a hammer for the day. That being said, it's very likely that we will get a bit of a bounce from this area, and it makes sense of course as there is a significant amount of support below going all the way down to the 1.28 handle.

I find it very difficult to sell this pair now, simply because there is so much in the way of noise below, and I do believe that the 1.28 level is a massive support below as well. On the other hand, I'm not exactly comfortable buying this pair either simply because of all the choppiness between here and 1.32 going forward.

Independence Day

You have to keep in mind that the session today is a holiday in the United States, namely Independence Day. Because of this the liquidity in this market will be almost nonexistent during the American trading hours, and as a result I believe that the market will only see action during the Asia and Europe hours. But having said that, Friday is also nonfarm payroll, and that of course will trump everything.

The nonfarm payroll number will have a massive effect on how the market trades, simply because it will adjust or confirm expectations for tapering out of quantitative easing by the Federal Reserve. It really is going to be a question whether or not the Dollar continues to strengthen, or if it sells off. It has almost nothing to do the Euro at the moment, and is completely weighted towards the Dollar. That being said, if we get some type of rally, it's likely that I will be selling this pair closer to the 1.32 level on the first signs of resistance. If we can get below the hammer bottom, that would also be a nice sell signal as well, but I would not be as enthused about that as there is simply far too much choppiness below, and I know that the area has proven itself to be supportive in the past.