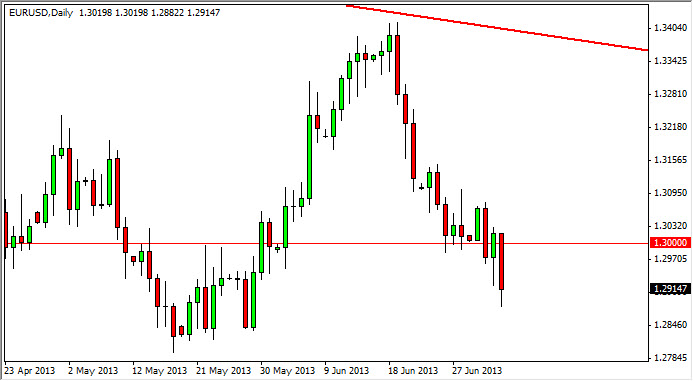

The EUR/USD pair fell hard during the session on Thursday, breaking well below the 1.30 handle again. However, looking at this chart we can see quite a bit of noise below, and I think that the area below offers enough support to keep this market from completely falling apart.

The Thursday session was Independence Day in the United States, so there was an entire section of the day that had almost no trading volume. With that being the case, I do not necessarily trust this breakdown with any great certainty, and as a result I am actually believing at this point in time that we will see a bit of a bounce from this general vicinity.

Nonfarm payroll is today

Nonfarm payroll is today, so of course there can be a great effect on this particular pair. That is because it is without a doubt one of the most liquid, if not the most liquid market in the world. So obviously, when an announcement comes out that has a great of an effect throughout the markets in general, it will certainly move this pair as well.

I think that we are still consolidating between the 1.28 handle on the bottom, and the 1.32 level on the top. Because of this, I have actually been avoiding this pair, simply because there is so much in the way of noise and choppiness that it is a very difficult market to be involved in for any length of time. After all, we have seen this market bounce around in an area between 1.30 and 1.28 before, but have also seen a break out of the area and the pair go up to the 1.32 handle.

Going forward, I think that the summer range will continue and there of course is quite a bit of headline risk out there at the moment as well. Because of this, I am essentially ignoring this pair, but if you do find yourself trading it, please keep in mind to keep your targets and stop losses tight as the markets have been so extraordinarily volatile.