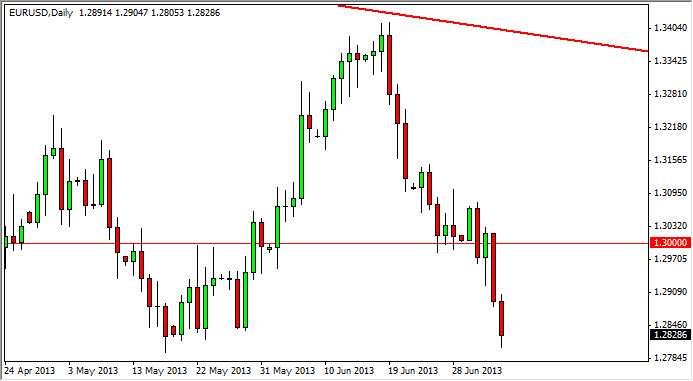

The EUR/USD pair fell on Friday again as the US nonfarm payroll numbers came out stronger than anticipated. The United States added 195,000 jobs during the month of June, and as a result the markets have started to price in the possibility of quantitative easing being tapered off starting in September by the Federal Reserve. Contrasting this with the European Central Bank and its pledge to keep rates "extraordinarily low" for an extended amount of time has traders fleeing the Euro, and heading into the Dollar.

Interest rates rose in America during the Friday session, and of course the strength of the Dollar. Most Forex traders have no idea, but it seems to be more often than not the bond markets that move money more than anything else. Because of this, interest rates are one of the primary drivers of this currency pair. Currently, it is obvious that the Americans are going higher, while the Europeans are either going lower or simply staying as low as they are at present. Either way, this favors the United States.

The 1.28 level is significant though

The fact is that the 1.28 level is a significant support area, and as a result I can't sell this pair at the current level. What I want to see is some type of bounce, and we probably will get it considering how far we have fallen in the last two days. That bounce will be used to sell this pair though, and because of that we should see a nice selling opportunity somewhere near the 1.30 level.

However, there is the possibility that we will just simply break down from here, and I would consider the support level broken if we close below the 1.2750 handle. At that point in time, I would say that almost all support has been surrendered, and that the bearishness of this market would simply continue to melt down. However, the Euro seems to have about nine lives at any given moment, so every time we think that the Euro is about the completely fall apart, something comes along to save it.