The salient points I made in my last analysis of EUR/USD on Thursday 18th July were:

1. It still seems the impetus for now is slightly bullish.

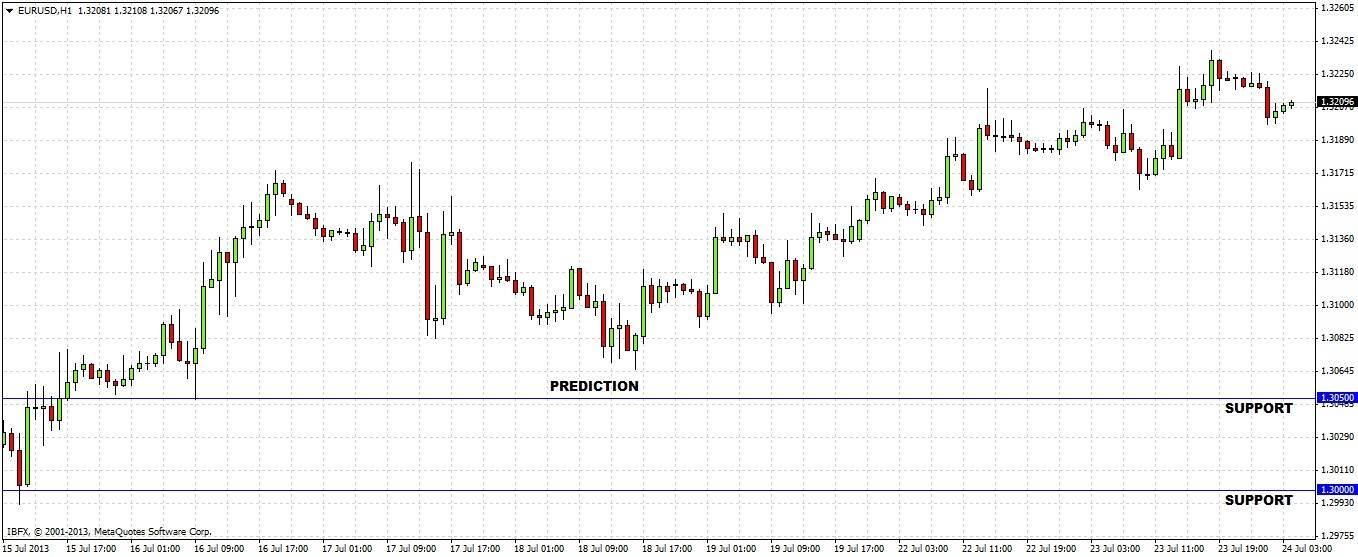

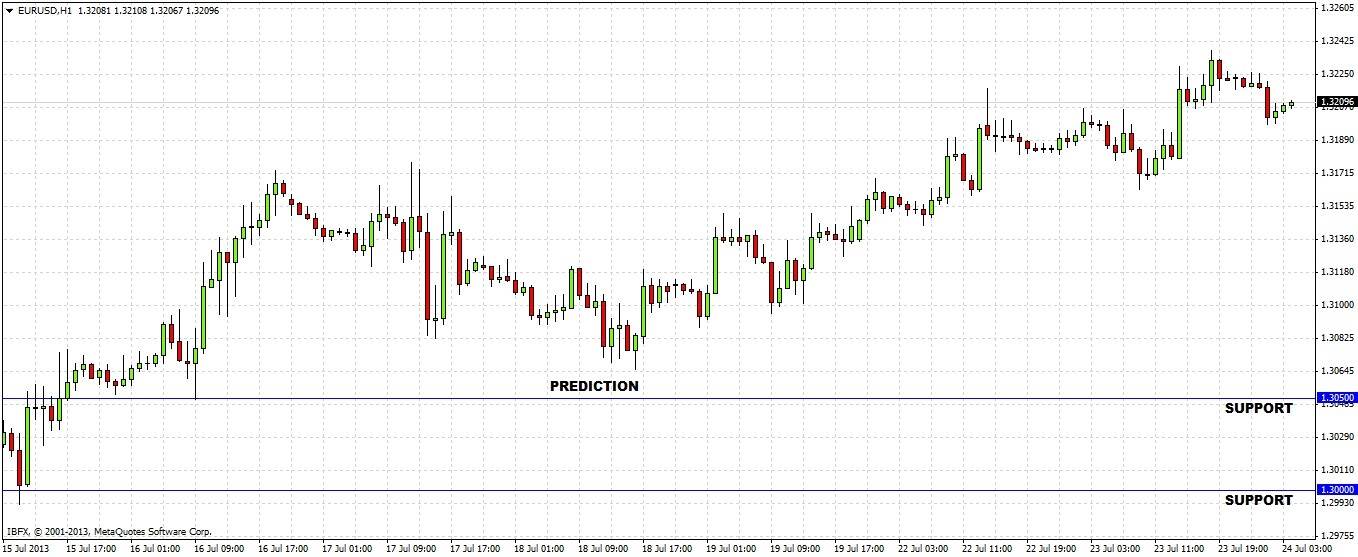

2. Therefore the rest of this week it is advisable to look for longs at bullish reversals around the 1.3050 and 1.30 areas where there is support for now.

3. If the price does not break 1.3205 before this week's close, it would be a sign of a pause in the bullish momentum.

I got it partly right: within just a few hours, the price dropped to 1.3065, just 15 pips above 1.3050, and has been trending bullishly ever since, reaching a high of 1.3239 last night. However, last week did close well below 1.3205, but it still seems the bullish momentum has not paused.

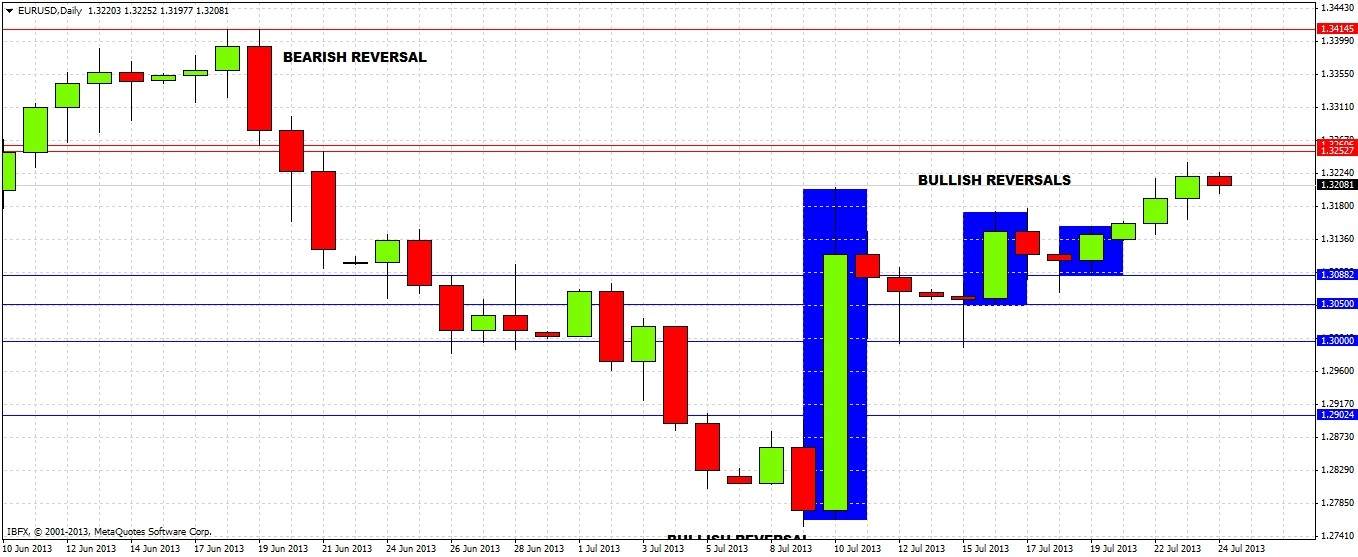

The weekly chart looks pretty bullish: a bullish reversal two weeks ago, followed by a bullish inside bar last week, both of which have already been broken to the upside this week. However we are now well within the territory of the bearish reversal candle that fell from 1.3415, so we might expect some resistance overhead:

Turning to the daily chart, we have been in a clearly bullish pattern since 10th July, with a succession of three bullish reversals (the second two acting as continuations). The blue lines show support, the red lines resistance:

Clearly the bias is bullish, but we are approaching what is likely to be fairly serious resistance overhead at around 1.3250, which is also a number of minor psychological importance.

As there is quite strong bullish momentum, I would be nervous to take any shorts off of the zone around 1.3250 unless the bullish trend really slows down first for a few days and we get some consolidation instead. Grabbing a few pips off a fast spike up there could be OK, but I would not take any swing trades short today or tomorrow.

If the price should break through 1.3260, it is likely that it will not go very far to the upside. 1.33 should also act as resistance, but if that is broken decisively then 1.34 is achievable.

If the price should fall during the next few days and bounce off any of the support lines below, these would be great opportunities for longs.

My gut feeling is that we will fail to decisively break 1.3260 to the upside, and the bullish momentum will weaken.