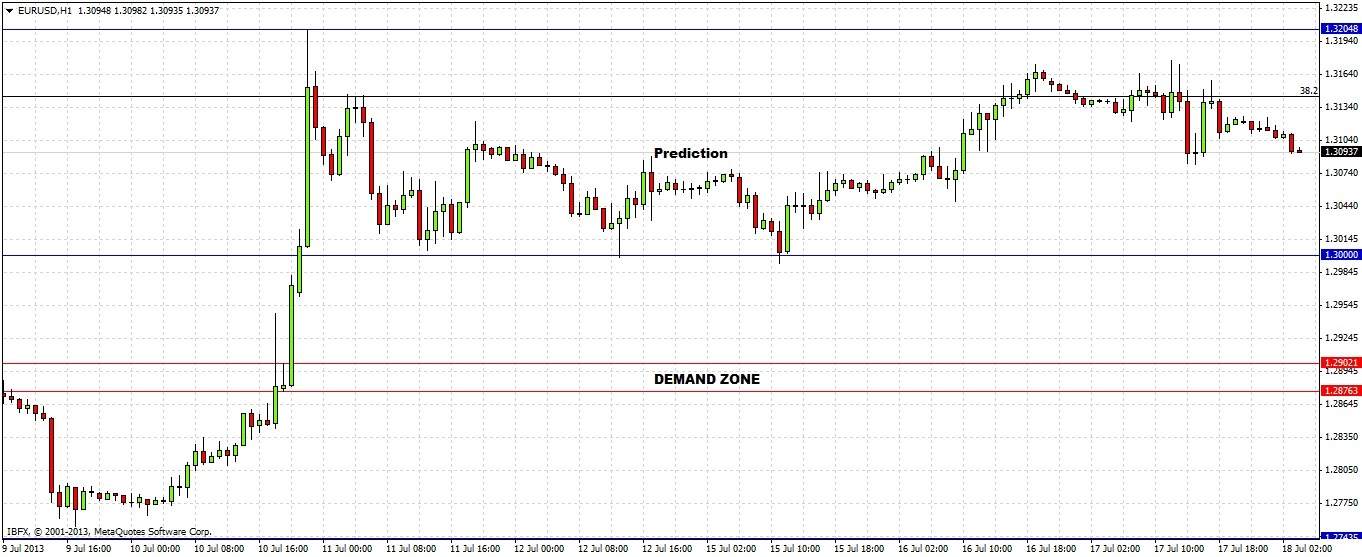

Here are a few highlights of the relevant predictions I made in my last analysis of EUR/USD last Monday:

1. The outlook is now bullish.

2. The surest move of the coming week or so is likely to be bullish, targeting last week's high of 1.3205.

3. There is some natural support at around 1.30 which looks like a good area to look for longs, should price retrace there before reaching 1.3205 first.

I got it right: within just a few hours, the price dipped a little below 1.30 and then made a fairly strong bullish move, peaking Tuesday night at 1.3173.

Looking at the daily chart, we can see that Tuesday produced a strong bullish reversal, following the long lower wicks of the previous three days, which were all contained within the range of the previous bullish reversal candle on 10th July:

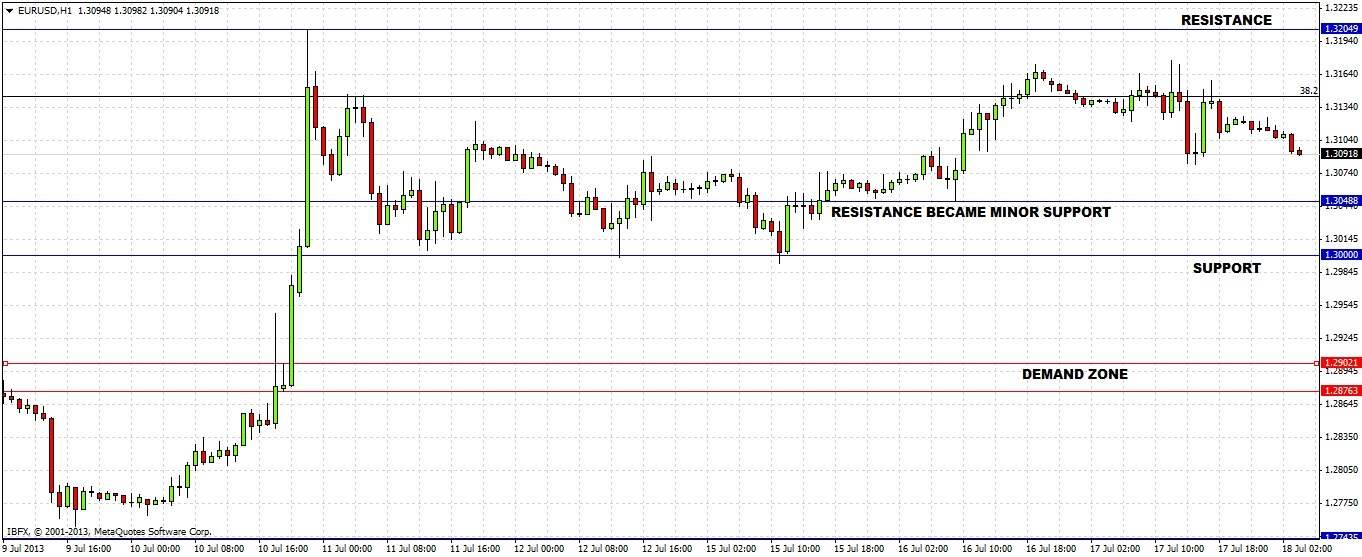

Although Tuesday's bullish reversal was just broken to the upside the next day, there is little bullish momentum. So, although the overall picture remains bullish, again we need to drop down to the hourly chart for more clues as to what is really going on with this pair:

Resistance became support at 1.3050, however the price has been falling off since Tuesday night. It still seems the impetus for now is slightly bullish.

Therefore the rest of this week it is advisable to look for longs at bullish reversals around the 1.3050 and 1.30 areas where there is support for now. If the price falls to the 1.29 area soon, I would expect a potentially very good long trade to set up there.

If the price does not break 1.3205 before this week's close, it would be a sign of a pause in the bullish momentum.