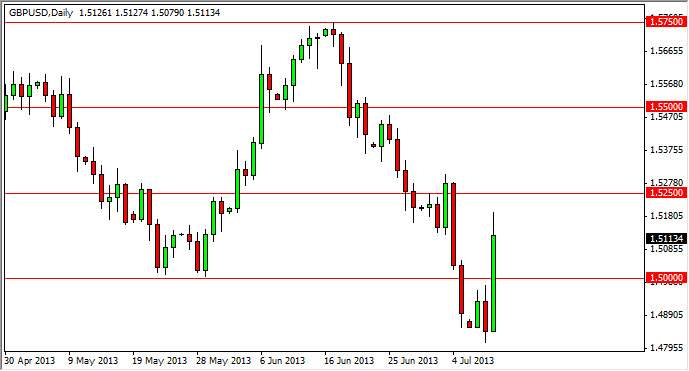

The GBP/USD market shot straight through the 1.50 level like it wasn't even there on Wednesday. This of course was predicated upon the Federal Reserve releasing minutes from the last meeting suggesting that several of the members were concerned about the employment rate in the United States, and that tapering off of quantitative easing may be stymied by that exact problem.

Because of this, the British pound got a bit of a reprieve, but you'll notice that the market still has a significant amount resistance above at the 1.5250 level, an area that I think the market will struggle with in general. In fact, I would love to sell a resistive candle in that vicinity, but have to wait until it prints. After all, trying to anticipate the market is one of the best ways to lose money, something that we are all trying not to do.

The UK isn't going as well as the US, regardless of the minutes

Regardless of what the Federal Reserve released during the Wednesday session, the UK is not going as well as the United States right now. Because of that, the United States is probably still closer to tapering off of quantitative easing than the British are, and as a result I believe that sooner or later the sellers will step back into this pair.

Going forward, I have a hard time believing that we will break through this region just above, but even if we do I don't see the 1.55 level giving way anytime soon. Regardless, I am not interested in buying this pair simply because it goes against the longer-term trend. However, I do not have that resistive candle to start selling, so I am on the sidelines when it comes to the British pound. In the end though, I think that eventually we will see a continued breakdown of the cable pair, and as soon as the Americans look like they're ready to taper off of quantitative easing again, you can expect this pair to fall apart rapidly.