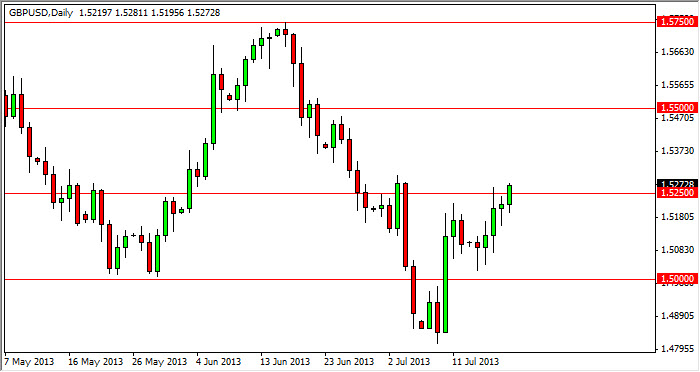

The GBP/USD pair rose during the session on Friday, as you can see smashing through the 1.5250 level. This is an area that I have suggested that would be resistive enough to keep the market down, but if it did not we could be going much higher. You can see that the market is currently pressing up against the highs from early July, so I think that this market breaking above 1.53 will remove all doubt, and send us looking for the 1.55 handle.

I am not a big fan of the Pound in general, but this move is pretty stout, and therefore I will be arguing with that. The 1.55 level should be rather resistive, but quite frankly I think the 1.5250 level was going to be more formidable. We could be seeing the beginning of a significant move higher, but again you have to keep in mind that the Forex markets are running on fairly low liquidity at this time of year. On top of that, the Forex markets tend to be very headline driven at the moment, and as a result the wrong headline could move the markets erratically.

1.55 is my target for now

I think a simple move up to 1.55 is achievable without too much fanfare. After all, once we break the 1.53 handle, it's only two more handles up to that level. It's a nice round number to shoot for, and a lot of traders will be attracted to it. Whether or not the sellers stepped in in large amounts would be a different question, but right now I have to assume that the markets will continue to be a right and choppy overall. When I say that, I don't mean just this market, but most markets.

I also believe that the 1.55 level would be an excellent place to see a nice selling opportunity if we get the right resistive candle. So in a sense, I have a long bias, with a short bias wrapped around it.