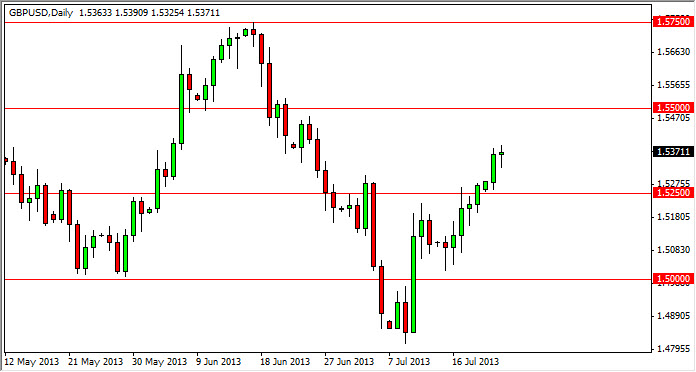

The GBP/USD pair went back and forth during the session on Tuesday, forming a hammer for the day. This market has recently broken above the 1.5250 handle, an area that we had suggested would be rather resistive. Because of this, we feel that the market has been "all clear" to head towards the 1.55 handle. It's up there that we should see significant resistance, but we think that the real question will be asked at that time.

For the short term, I am fairly bullish of the British pound, although to be honest with you I think this has more to do with US dollar weakness than anything else. I would be interested in shorting this market closer to the 1.55 handle if we do have the right resistive candle, perhaps a shooting star. But in the meantime, it definitely looks like the market wants to go higher, so I am not going to argue with that.

Hammer time

The fact that we formed a hammer for the session on Tuesday suggests to me that the market is going to have a very difficult time pulling back. Its because of that that I'm perfectly comfortable buying in this general vicinity, recognizing that the 1.5250 level should be supportive. That being the case, we feel that this market is a "buy only" market until we get well below the 1.5250 handle on at least a daily close. My suspicion is that this market will continue to be choppy though, so you will have to be very patient and waiting for the move to the 1.55 handle. Because of this, those of you who have the ability to play the options market may want to consider this.

Remember that we are in the dead of summer, and therefore the liquidity probably isn't quite there. That of course can exacerbate moves, so it's hard to tell what kind of "breakout" we could be seeing at the moment. Nonetheless, I do think that the next couple of hundred pips belongs to the British pound, and not the US dollar.