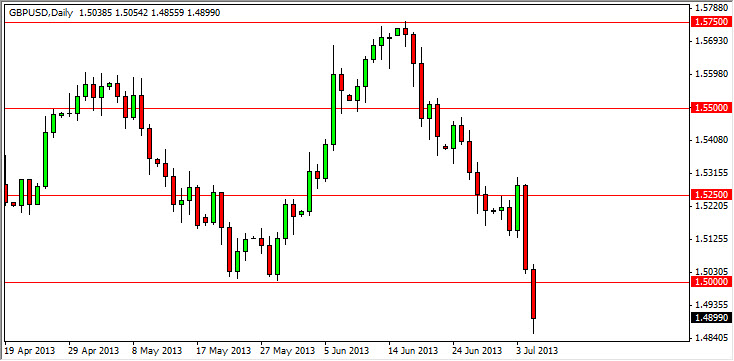

The GBP/USD pair fell hard during the Friday session, smashing through the 1.50 level like it wasn't even there. I had expected that area because there was quite a bit of support, but with the nonfarm payroll number coming out of America so strong, the British pound had absolutely no chance.

The fact that it appears the Federal Reserve is going to begin to taper off of quantitative easing in September and that the Bank of England is going to keep rates low for an extended amount of time, seems to be the driving force in the decline of this pair. However, you have to keep in mind that the longer-term charts show a significant amount of support down towards the 1.48 handle.

Watch out for the double bottom

The 1.48 level should be fairly significant for the longer-term direction of this pair, and quite frankly we have seen a significant meltdown over the course of the last two days. Because of this, it would not surprise me at all to see a bounce in this pair, but it should end up being a selling opportunity at this point. Resistive candles will be used to sell this pair, and I believe that we will eventually break down below the bottom but not quite yet.

It isn't until we get above the 1.5250 level on a daily close that I even begin to think about this pair from the buy side. In fact, I suspect that I will be selling this pair over and over for the next couple of weeks. I suspect that we will get a line of choppiness in this general vicinity, as it has been such a significant support level for the pair overall. The longer-term charts of course show that a break down below the 1.48 level will be drastic in its bearishness, and we could see a row meltdown that awaits. Nonetheless, I believe that the move is probably a little bit overdone at this point, so that bounce seems to be more and more likely. I will go down to the four-hour charts for entry signals in order to take advantage of the downtrend.