So, my prediction last Monday at the start of this week looked like this:

If we break 1.5305 decisively, we are quite likely to continue upwards until we meet the next major resistance level at around 1.5478.

If we are unable to break 1.5305 decisively, and we reverse and fall with momentum below 1.5280, we are likely to reach 1.5200 and possibly 1.5157.

For the time being, the momentum is bullish.

Let's see what actually happened:

Almost as soon as my analysis was written, there was a decisive breakout of 1.5305. The price then continued upwards to a high of 1.5390 before falling again, bouncing this morning at what seems to have become a support zone (the old resistance from 1.5280 to 1.5305). So we have not yet reached 1.5478.

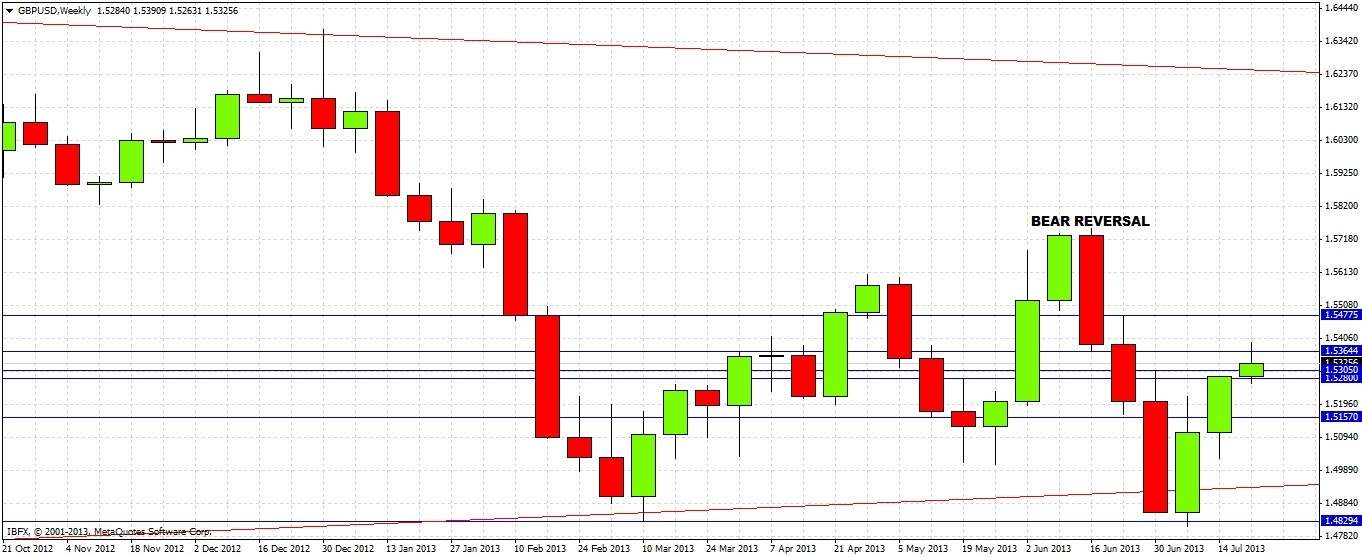

Turning to the future, it seems that reaching 1.5478 is now in serious doubt. Looking at the weekly chart, whose recent candles are still bullish, we have to note that we have just run into the zone from the weekly reversal with its low at 1.5364, which seems to have acted as resistance:

The picture becomes clearer in the daily chart. Yesterday was a bearish reversal, and in fact the USD did not just trace a reversal against GBP, but also did the same against EUR (weakly) and AUD (much more strongly), so we have to sit up and take notice of that:

I mentioned earlier that the zone between 1.5305 and 1.5280 seems to have become support. Crucially, yesterday's bearish reversal was unable to break down through this zone, despite it being a fairly significant move by USD. So this bearish reversal may not be very strong, and this may just be a pause in the recent bullish momentum, or the beginning of a consolidation period.

We need to wait for more clarity which will be provided as follows:

1. If the price breaks decisively downwards through the support at 1.5280 – the sooner the better, preferably today – we should turn bearish and target a fall down to about 1.5157.

2. If the high of yesterday's bearish reversal at 1.5389 is decisively broken to the upside – and again, the sooner the better, preferably today – we should resume our bullishness and expect to see 1.5478.

It is important to trade what you see, and not what you think. I'll mention what I tink anyway. My gut feeling is that unless we get some news that changes market sentiment, we are probably in for some consolidation. But a break of these levels I mentioned above should give us a bias.

My next analysis will not be until next week, so I'll say something about this week's close. If it is above 1.5305, that is a bullish sign for next week. If the close is below 1.5280, conversely, that will be bearish.