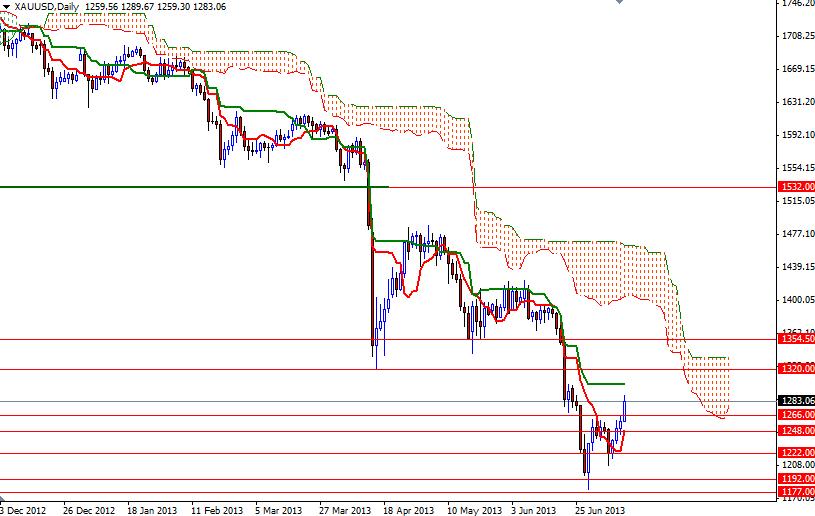

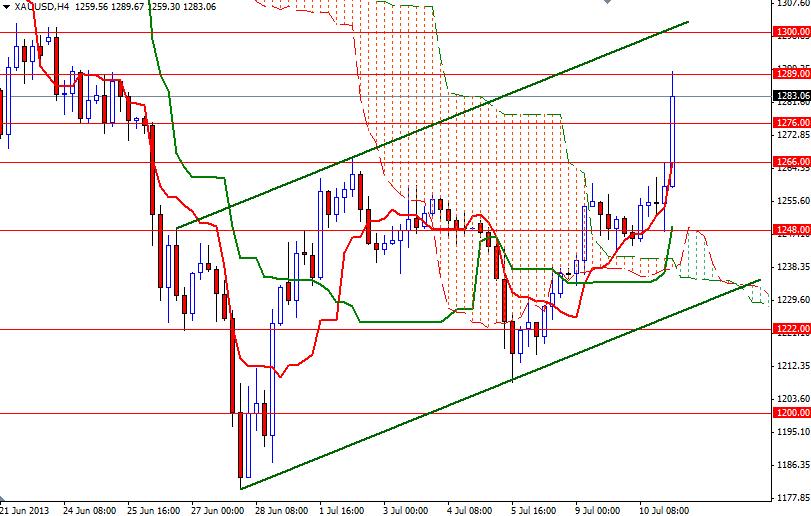

The XAU/USD pair closed higher than opening for a third consecutive day as minutes from the Federal Open Market Committee’s June 18-19 gathering revealed that officials wants to see substantial improvement in the labor market before they begin to reduce the size of asset purchases. Gold also drew strength from Federal Reserve Chairman Ben Bernanke's comments on quantitative easing program. Ben Bernanke said that “Highly accommodative monetary policy for the foreseeable future is what’s needed in the U.S. economy”. It appears the committee members believe that the labor market is in a better shape than it did at the time of the quantitative easing launch, but they will maintain the timetable and wait until the unemployment rate falls below 7%. After the news, during the Asian session today, the XAU/USD pair extended its gains and jumped to a two-week high as the bulls managed to break through the 1266 resistance level, currently the pair is trading at 1283.06. Technically speaking, trading above the Ichimoku cloud on the 4-hour time frame is supportive for gold prices. Since we also have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen line (twenty six-day moving average, green line) cross, I think that the recent correction will continue towards 1300 at least. Above 1300, I see a strong resistance at the April 16 low of 1321.52 and I guess this is where the real fight is going to happen. In the meantime, the 1289 level will offer some resistance. If the bears increase the selling pressure at that level and prices start to fall, there will be support at 1276, 1266 and 1248.

Gold Price Analysis - July 11, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Read more articles by Alp Kocak- Labels

- Gold