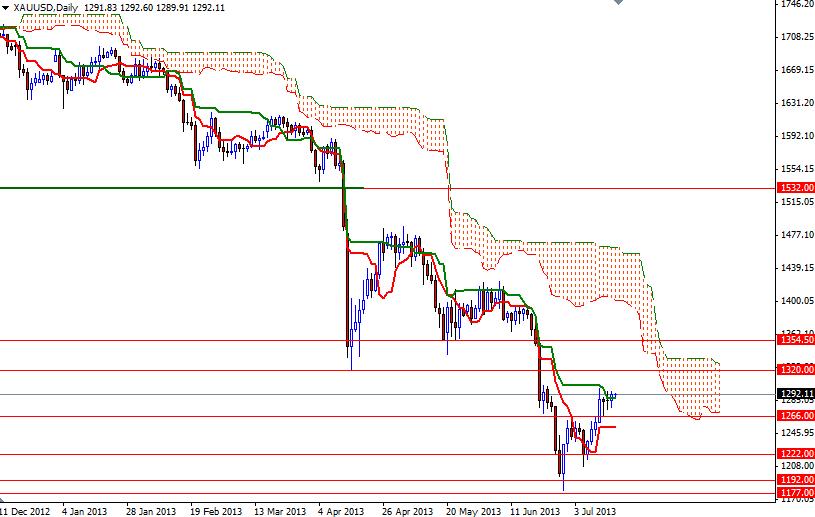

The XAU/USD pair scored a gain of 0.58% on Tuesday as weakness in the American dollar continued to lure some investors back to the market. The American dollar has been struggling since last Wednesday, when Federal Reserve President Ben Bernanke said a highly accommodative monetary policy would be needed for the foreseeable future. Most investors were expecting that the Fed would start reducing its stimulus as early as September. I think the Federal Reserve is going to maintain its timetable unless future data shows a weakness in the outlook for the labor market and in the mean time Fed officials will be focusing on clarifying the strategy so markets don't overreact when they actually begin tapering the rate of asset buying. From a technical point of view, short term charts (and an ascending triangle formation on the 4-hour time frame) suggest that a retest of 1320 is likely if the 1300 resistance level is cleared. Beyond 1320, I see plenty of resistance but if the bulls somehow get through this resistance point, that will probably bring more buyers in and then we could see a bullish continuation targeting the 1354 level which acted as a support in May. If prices reach that far and touch the Ichimoku cloud on the daily time frame, I will be looking signs of weakness to go short. To the downside, there will be interim resistance at 1286.40 and 1276. In order to gain the control over the XAU/USD pair, the bears will have to capture the 1266 level where the top of the Ichimoku cloud (on the 4-hour time frame) and the bottom of the ascending channel converge. If that happens, there is a good chance this pair will fall further and revisit 1248. The primary driver of gold prices will be Fed Chief Bernanke's congressional testimony today.

Gold Price Analysis - July 17, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold