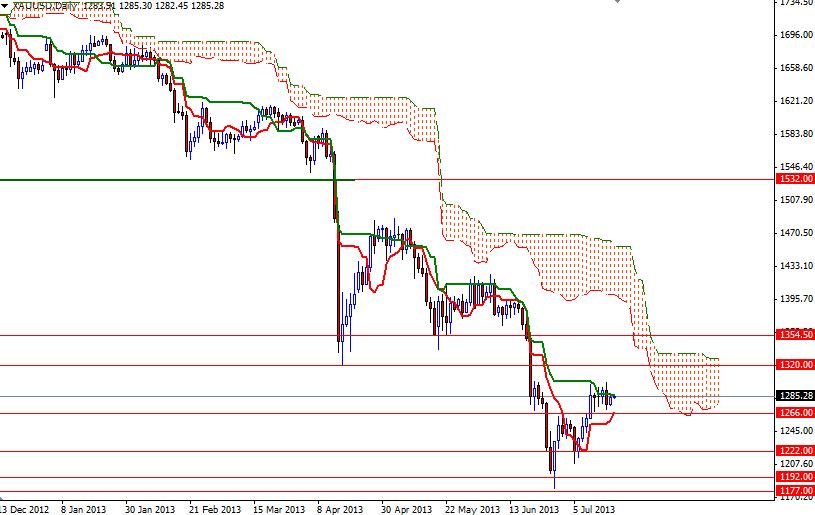

The XAU/USD pair closed yesterday's session higher than opening but remained within the last four days trading range. Gold prices gained some ground against the greenback even though a series of economic data out of the United States came out better than forecasts. The report released by the U.S. Labor Department revealed Initial jobless claims dropped 24K to 334K. According to data from the Federal Reserve Bank of Philadelphia, its index of regional manufacturing activity climbed to 19.8 from 12.5 the prior month. Honestly, I should say that the XAU/USD pair has been resilient to the bears' attacks over the last few days but the candlesticks show a lack of momentum at the moment. On the daily and weekly time frame, gold prices are still below the Ichimoku cloud but on the 4-hour time frame we are above the cloud. Since the long term and short term charts give conflicting signals, I think the pair will have a hard time gaining traction in either direction at this point. Recently we have been trading within the tight trading range of 1275 to 1289 so short term traders should pay attention to these two support-resistance levels. However, as I mentioned in my previous analysis, I believe that 1300 and 1266 will the key levels for a better trading opportunity. If the pair can manage to close above the 1300 level, the bulls might find extra support they need to test the April 16 low of 1321.52. Beyond this level, there will be strong resistance at 1354.50. If the bears win the battle and we break below the 1266 support level, I will look for 1253 and 1248. Breaking below 1248 could act as confirmation that the momentum is once again turning bearish.

Gold Price Analysis - July 19, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold