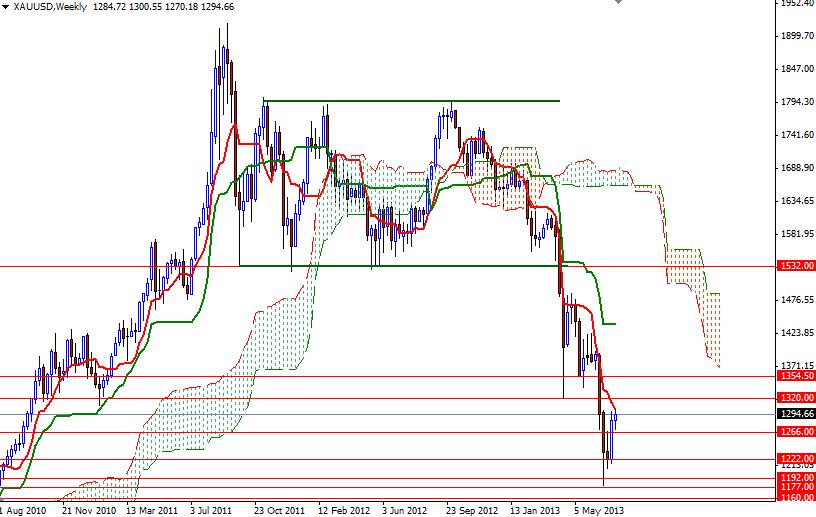

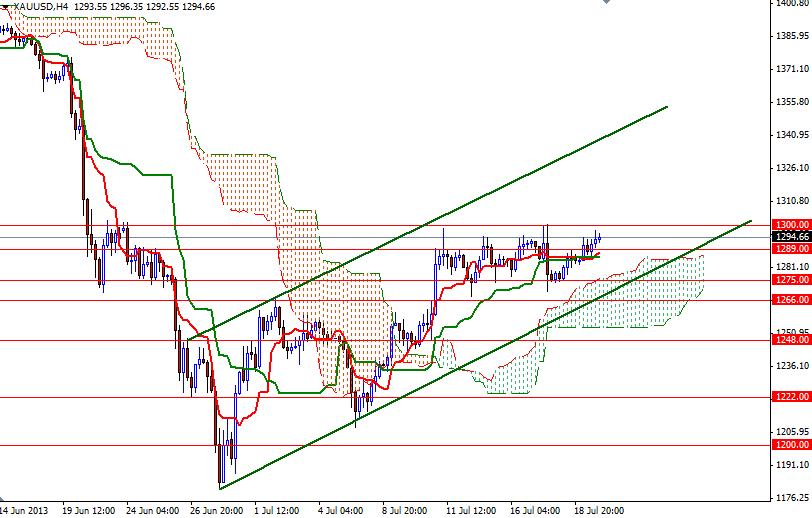

The XAU/USD pair scored a gain of 0.78% on a weekly basis as congressional testimony from Federal Reserve President Ben Bernanke, who said there was no predetermined pace of reductions in the asset purchases, eased the greenback’s safe-haven appeal. Although he has done nothing to shed light on when the quantitative program will come to an end, now the market players think that the Fed will keep its bond-buying stimulus in place at least a little longer than what they thought just a few weeks ago. However, there is one thing clear: the era of cheap central bank money is coming to an end. The lack of Fed purchases will probably affect long term interest rates and major stock markets. If investors shift money from other assets to gold market, the recent correction might continue a bit longer. Data from the Commodity Futures Trading Commission (CFTC) show that speculative investors increased their net-long position in gold to 23462 contracts, from 16557 a week earlier. Recently, the price of gold has been continuously held in check by the key 1300 upside barrier/resistance, so in order to confirm that the bulls are dominant, I believe that a sustained break above this level is essential. On the 4-hour time frame, the XAU/USD pair is trading above the Ichimoku cloud and we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross, indicating that we have more pressure from the bulls than bears in the short-term. If the 1300 resistance is broken, it is likely that we will see the bulls testing the next strong resistance levels at 1321.54 and 1354. If the bulls fail and prices reverse, support can be found at 1289/5, 1275 and 1266. Once below 1266, there is little to slow this pair down until we reach the next key support at the 1248 level.

Gold Price Analysis - July 22, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold