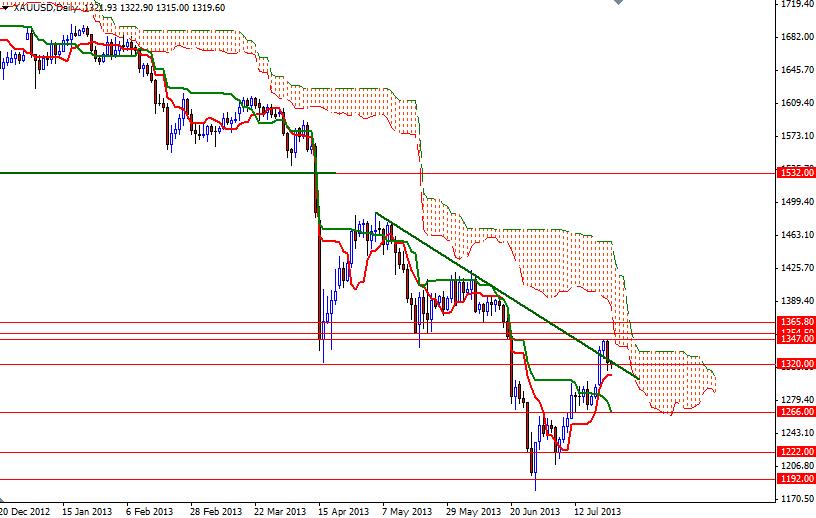

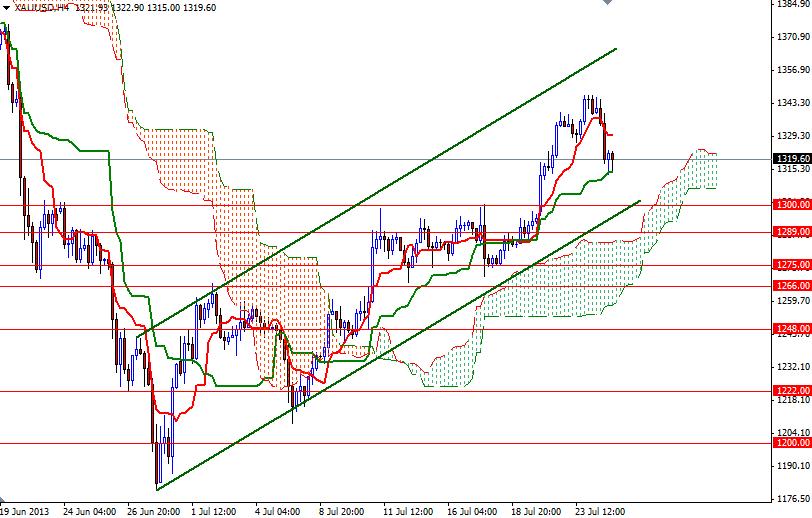

The XAU/USD pair (Gold vs. the American dollar) settled lower yesterday, pulling back after sizable gains in the previous sessions, as better-than-estimated U.S. new home sales and manufacturing PMI data increased demand for the greenback ahead of today’s durable goods orders and unemployment claims reports. Data released from the Commerce Department showed that purchases climbed 8.3% to an annualized pace of 497000 homes and Markit reported that July flash purchasing managers’ index rose to 53.2 from 51.9. It appears that weakening Chinese economy and encouraging U.S. data will keep some pressure on the precious metal. From a technical perspective, there are two things which I pay attention most. On the 4-hour time frame, prices are trading above the Ichimoku cloud and the market is following an ascending channel. However, as I pointed out in yesterday's analysis, gold prices are approaching the clouds on the daily chart and that means the bulls will likely to struggle breaking through. The XAU/USD pair is currently trading at 1319.60, hovering just above the Kijun-Sen line (twenty six-day moving average, green line) and the bottom of the ascending channel converges with both the 1300 level and the top of the Ichimoku cloud. If we break below the Kijun-Sen which sits at 1314, the pair will probably test 1307 and 1300 next. The support zone between the 1300 and 1275 will act as a key. If prices close below 1275, there is a strong possibility that the bearish trend will resume and the bears will be challenging the bulls at 1266 and 1248. If the 1300 level holds and the prices turn north, expect to see resistance at 1329.86, 1347 and 1354.50.

Gold Price Analysis - July 25, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold