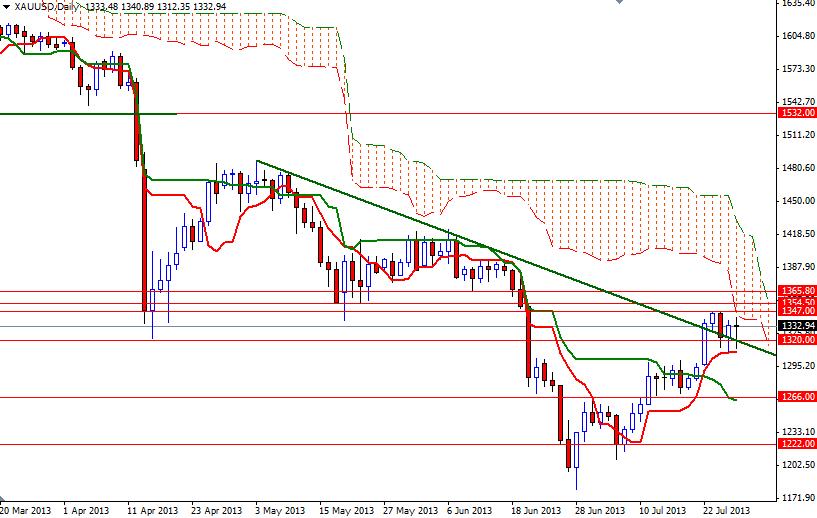

For a third week in a row, the XAU/USD pair settled higher than opening but the last few trading sessions have been choppy at best. During Friday's trading session the pair traded as low as 1312.35 after the University of Michigan reported that its consumer sentiment index climbed to 85.1, well above a preliminary reading of 83.9, but prices bounced back to 1332.94 as buyers stepped in. Lately, the XAU/USD pair has been resilient to optimistic U.S. economic data but this is not really surprising if we consider the fact that gold prices have been falling constantly since October 2012. As a result, we found ourselves in an important level ahead of a very critical week. The Ichimoku clouds are blocking the bulls' way on the daily chart but on the 4-hour time frame the Ichimoku clouds are acting as a support. That means we will likely to remain trapped a relatively small trading range until the market gets a clear signal from the Federal Reserve this week. Without doubt, the outcome of the FOMC meeting which will be held on June 30-31 and Friday's employment figures are probably going to be the next big market catalysts. Data from the Commodity Futures Trading Commission (CFTC) show that speculative investors increased their net-long position in gold to 34191 contracts, from 23462 a week earlier. Recent price action suggests that neither the bulls nor the bears have enough power to overcome certain support/resistance levels and because of that I would like to wait until this battle is over. If the XAU/USD pair continue to trade above the clouds (4-hour chart) and break above the 1347 level, I think the bulls will be aiming for 1354.50 and 1365.80 next. However, if the bears successfully defend this barrier and prices reverse, expect to see some support at 1320, 1310 and 1300. A sustained break below 1300 would take us back to the 1275 level.

Gold Price Analysis - July 29, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Read more articles by Alp Kocak- Labels

- Gold