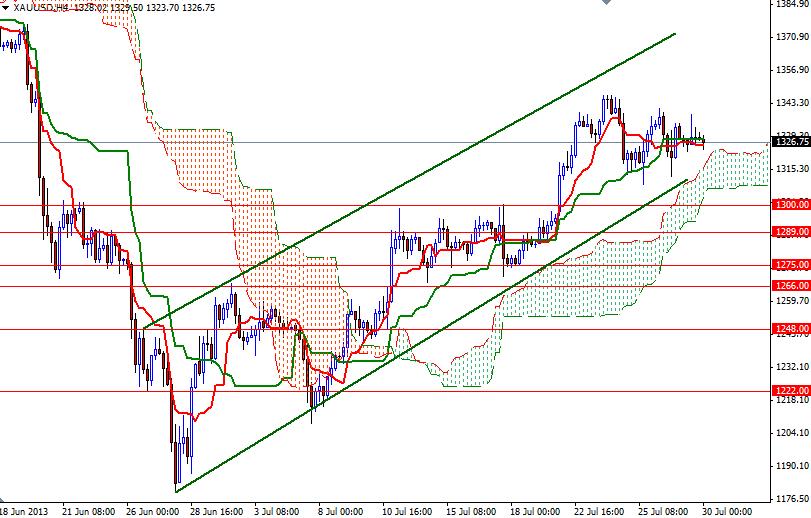

Gold prices (XAU/USD) settled slightly lower yesterday as the mild disappointment in U.S. housing data failed to have a lasting impact on the Greenback. Figures from the National Association of Realtors showed the index of pending home sales dropped 0.4% in June but were more or less in line with market expectations. The trading action is getting tight, the candlesticks are indicating a real lack of momentum and most traders are reluctant to take sizable positions ahead of ahead of the Federal Open Market Committee's two-day policy meeting which begins today. Looking at the daily and weekly charts from a purely technical point of view, I see the bulls are stronger compared to the previous bounce that we witnessed back in April. However, the Ichimoku clouds which are above the prices suggest that there are tough resistance levels ahead. On the other hand, the XAU/USD pair is trading above the cloud on the 4-hour time frame and because of that, I can't eliminate the possibility of a bullish price action in the short term. With this in mind, I think it makes more sense to wait until we break out of this consolidation zone. The key levels to watch will be 1347 and 1300. If the Federal Reserve meeting results in a dovish policy outlook and prices can break through 1347, I will look for 1354.50, 1365.80 and 1388. Since there is strong resistance between 1388 and 1400, I think the bulls will struggle to pass this barrier. If the American dollar gets a boost from the upcoming events and the XAU/USD pair makes a sustained break below the 1300 level, it is very likely that we will see the 1266 support being tested next. On its way down, expect to see some support at 1289 and 1275.

Gold Price Analysis - July 30, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold