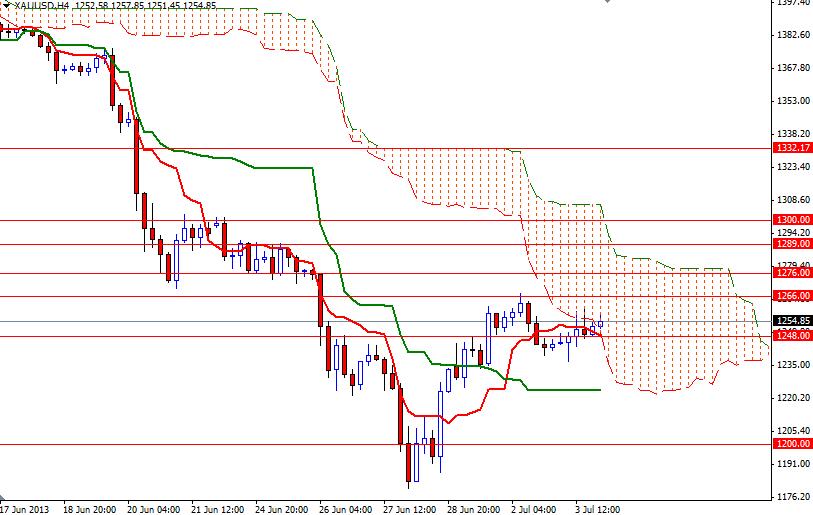

The gold market appears to be stable with the bulls and bears gaining and losing ground almost equally during the Asian session. Yesterday the XAU/USD pair had a slightly bullish session as worries over political turmoil in Portugal and mixed economic data out of the world's largest economy increased gold's attractiveness as a safe-haven asset. Escalating tension in Egypt is another element supporting gold prices. Figures from the ADP Research Institute showed that private sector added 188000 jobs in June, more than expectation of 166000 but Institute for Supply Management said that its services index fell to 52.2 in June from 53.7 a month earlier. Separately, the Labor Department reported that the number of Americans filing first-time claims for unemployment insurance payments decreased by 5K to 343K. Today the gold market remains steady during the Asian session as most investors are waiting for the official non-farm payrolls report. Although geopolitical tensions usually increase the demand for gold, today's trading volume is expected to be thin today as U.S. financial markets will be closed for the Independence Day holiday. From a technical point of view, I think following the 4-hour chart is best idea at the moment because prices entered inside the Ichimoku clouds. This suggests that the short term trend is flat and the pair is looking for a direction. Because of that I will be just watching the market until we completely leave the cloud. Intra-day traders should pay attention to the 1266 and 1235 levels as we oscillate around 1248. If the bulls gain some strength and push the pair above the 1266 level, we may see a bullish attempt towards 1300. On its way up, there will be resistance at 1276 and 1289. If the bears increase the downward pressure and prices fall below 1248, expect to see support at 1235 and 1222. A break below 1222 would indicate that the bears are aiming for 1200.

Gold Price Analysis - July 4, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Read more articles by Alp Kocak- Labels

- Gold