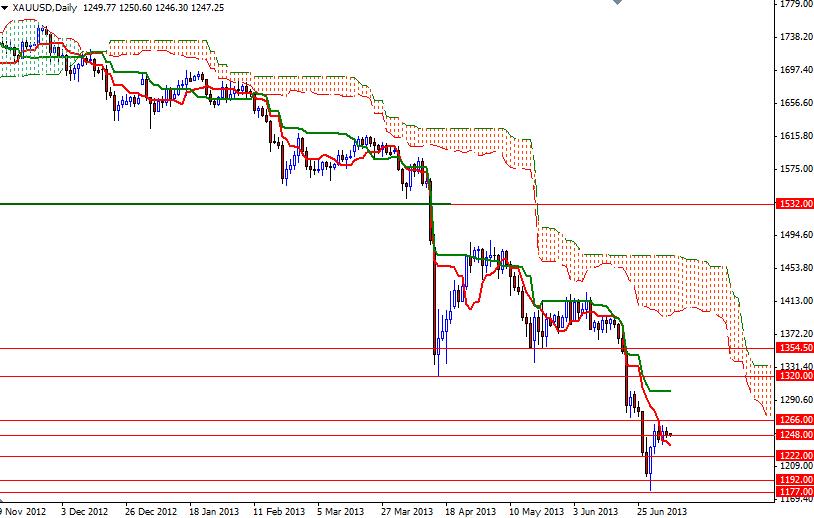

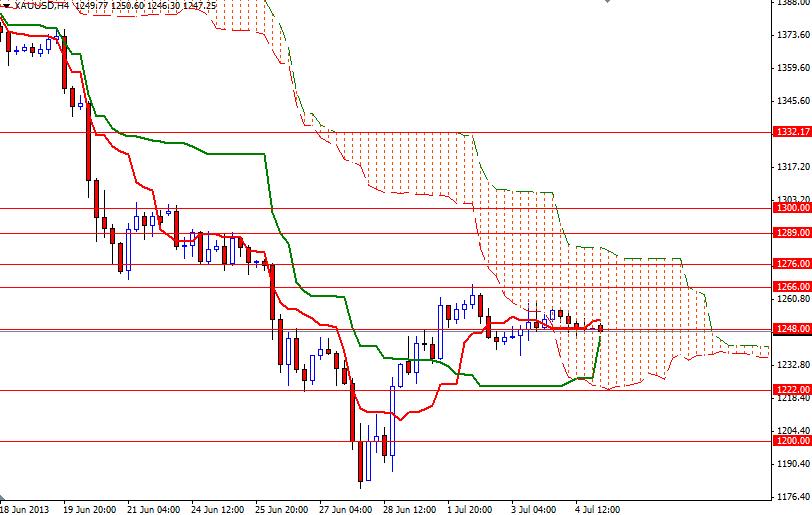

The XAU/USD pair ended the yesterday's session with a small loss but remained within the last three days trading range. Although the American dollar gained some strength after the European Central Bank (ECB) President Mario Draghi said “Our monetary policy stance will remain accommodative for as long as necessary. The Governing Council expects the key ECB interest rates (including the rate on the deposit facility) to remain at present or lower levels for an extended period of time...We are technically ready (to introduce negative rate) and it has been included in the options we will have in the future” at his press conference, gold market had a very limited reaction. The concerns over China's economic health, subdued inflation and growing expectations that the Fed will cut its monthly bond purchases of $85 billion by $20 billion at its September meeting continue to keep constant pressure on gold prices. Looking at the long term charts from a purely technical point of view, I see the bulls are getting weaker compared to the previous bounce that we witnessed back in mid-April. Moving inside the Ichimoku cloud (on the 4-hour time frame) indicates that the XAU/USD pair will be consolidating until the bulls or bears start to dominate the market. In other words, this area (Ichimoku cloud) will decide the direction for this pair for the near term. In the meantime, prices will probably be wondering around the 1248 level. Support to downside can be found at 1235 and 1222. If the American dollar gets a boost from the upcoming fundamentals and prices break below the 1222 level, which is the bottom of the cloud, it is very likely that we will see the 1200 support being tested next. If the bulls take over and prices start to climb, the bears will be waiting at 1266 and 1276/9 levels. A sustained break above this level might give the bulls extra power they need to tackle the 1300 barrier.

Gold Price Analysis - July 5, 2013

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

About Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Read more articles by Alp Kocak- Labels

- Gold